Weekly Methanol Report 6th November 2020

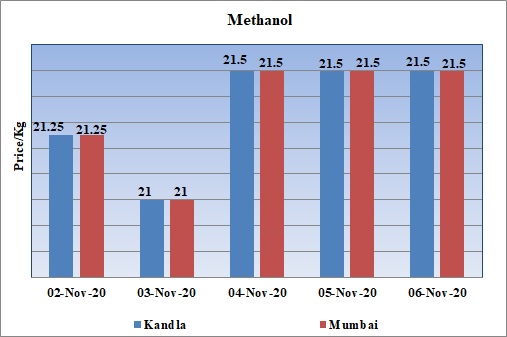

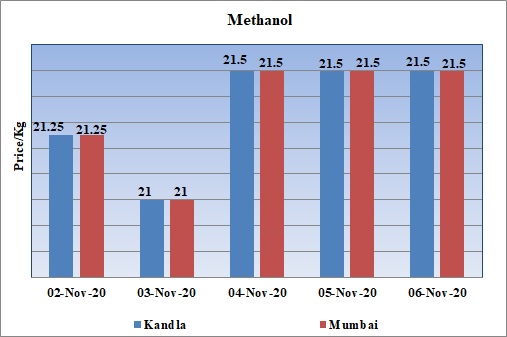

Weekly Price Trend: 02-11-2020 to 06-11-2020

- The above graph focuses on the Methanol price trend for the current week. Prices remained stable for most of the week. There has been slight rise in prices for this week.

- By the end of the week prices were assessed at the level of Rs.21.5/Kg for this week.

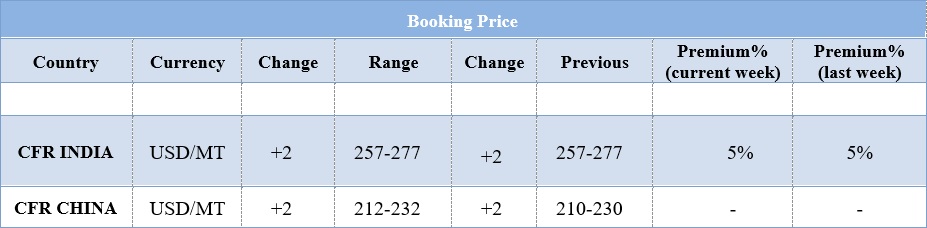

BOOKING SCENARIO

INDIA & INTERNATIONAL

- This week domestic market prices of Methanol remained flat throughout this week. Prices were assessed in the range of Rs.21-21.5/Kg.

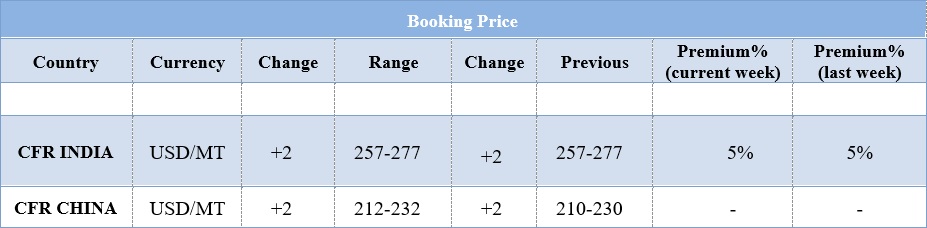

- Prices for India were assessed around USD 267/MT, with slight rise in prices for this week. CFR China prices were assessed around USD 222/MT for this week. Prices were increased by USD 5/MT for this week.

- On other side CFR SEA prices were assessed in the range of USD 270/MT.

- Domestic market for Methanol remained flat throughout this week. There has been Methanol the main product of Indian market has now increased its reach and the amount of import has also increased. Last two months’ average import was of 85% of last year imports. Still heavy stock is available at Indian ports.

- With bulk import in last two months there was heavy dip in imports in the month of October. Purchase in the spot market was lowered by 55,00- 60,000 tonnes. Very slow trading and dull market remained the key features for this week.

- Experts believe that this weak spot trading is likely to stay in the month of November as well. There are very few offers from Middle East.

- China has been focusing more on MTO units. With concern to pollution industry has been more focused towards methanol based Olefins units rather than coal based olefins units.

- China imports mostly from Iran and with winter approaching there would be decline in production of Methanol in Iran due to shortage in the supply of gas.

- Canada based Methanex has posted its North American and Asian contract prices for the month of November 2020. Asian contract prices are USD 310/MT, increased by USD 10/MT for this month while prices posted for North America is USD 379/MT.

- Crude market remained subdued for this week. With upcoming Diwali festival in next week the demand remains weak for this week.

- In oil field India has requested OPEC to review its pricing policies for the Asian market and end the premium it puts on its crude for Asia in virtual OPEC-India Dialogue meeting with OPEC Secretary General Mohammad Barkindo on Thursday.

- India depends on OPEC for 78 percent of its crude oil demand, 59 percent of liquefied petroleum gas (LPG) demand, and nearly 38 percent of its liquefied natural gas (LNG) demand, the Indian minister said, noting that India imported US$92.8 billion worth of oil, gas, and petroleum from OPEC members in the 2019-2020 financial year.

$1 = Rs. 74.20

Import Custom Ex. Rate USD/ INR: 75.15

Export Custom Ex. Rate USD/ INR: 73.45