Weekly Methanol Report 25th December 2020

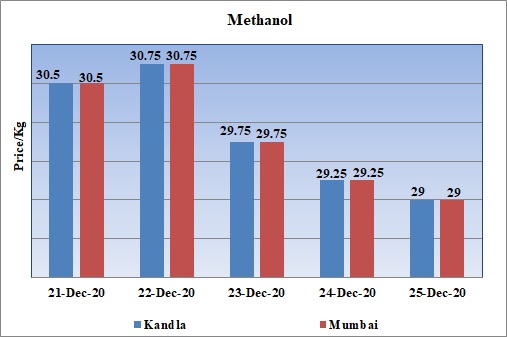

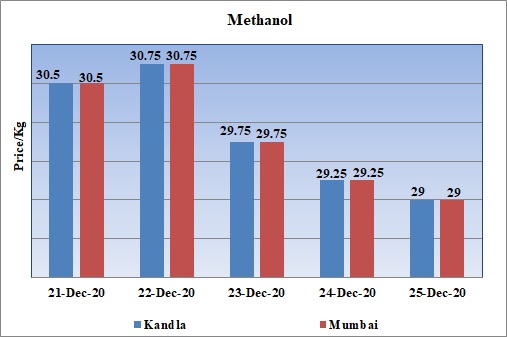

Weekly Price Trend: 21-12-2020 to 25-12-2020

- The above graph focuses on the Methanol price trend for the current week. Prices –remained highly vulnerable for this week.

- By the end of the week prices were assessed at the level of Rs.29/Kg for this week. Prices were anticipated to remained weak for this week.

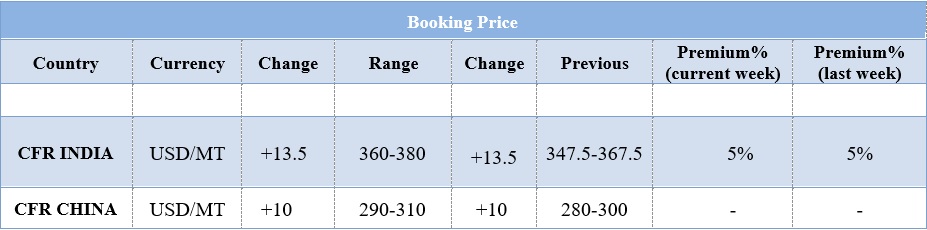

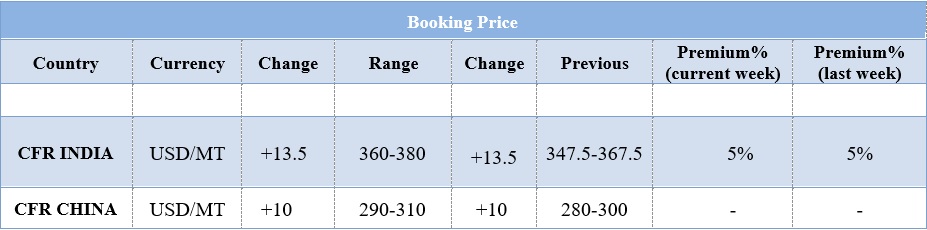

BOOKING SCENARIO

INDIA & INTERNATIONAL

- Domestic prices for Methanol were assessed at the level of Rs.29/Kg for this week.

- Prices for India in international market were assessed around USD 370/MT, with an increase of USD 13.5/MTS for this week. CFR China prices were assessed around USD 300/MT for this week. There has been rise of USD 10/MT in China values.

- FOB Korea values were assessed around USD 360/MT for this week.

- On other side CFR SEA prices were assessed in the range of USD 356/MT.

- Domestic market for Methanol remained firm for this week. With onset of winter and outage of major units has led to decline in the supply of the chemical.

- Prices in Asian market are likely to move in upward direction in next week as well as there has been tight supply of chemical due to many unplanned maintenances of many units. Again there has been limited supply of Methanol from Middle East leading to building of pressure on the prices Methanol in international market.

- Two major shipments of Methanol are expected to arrive soon on Indian ports.

- Methanex has also increased its Asian Contract prices significantly for the month of January 2021. New prices posted at USD 405/MT increased by USD 55/MT for this week.

- Experts believe that domestic supply is likely to remain tight as many regional manufacturers has delayed their production.

- The robust demand of Methanol due to winter season and application of gases and again demand for Methanol has also increased in construction sector.

- Here it is also believed that demand for methanol from derivative products including acetic acid and formaldehyde, is anticipated to remain strong as economies bounce back from the COVID-19 pandemic.

$1 = Rs. 73.55

Import Custom Ex. Rate USD/ INR: 74.45

Export Custom Ex. Rate USD/ INR: 72.75