Weekly Methanol Report 16th October 2020

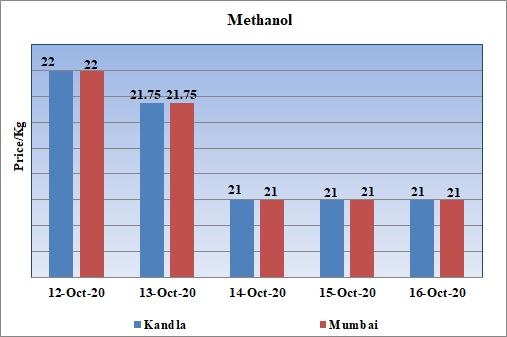

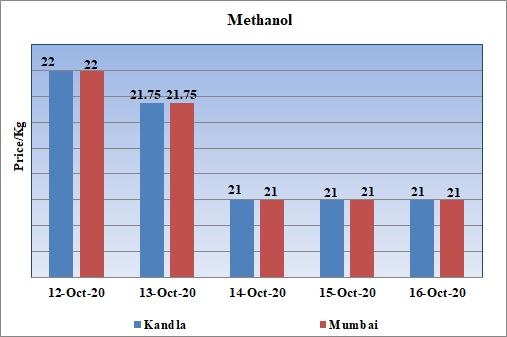

Weekly Price Trend: 12-10-2020 to 16-10-2020

- The above graph focuses on the Methanol price trend for the current week. Prices remained stable for most of the week. There has been decline in prices for this week.

- By the end of the week prices were assessed at the level of Rs.21/Kg for this week. Prices depleted by Rs.1/Kg for this week.

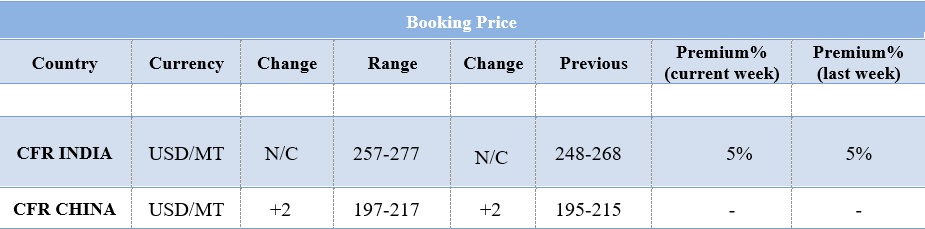

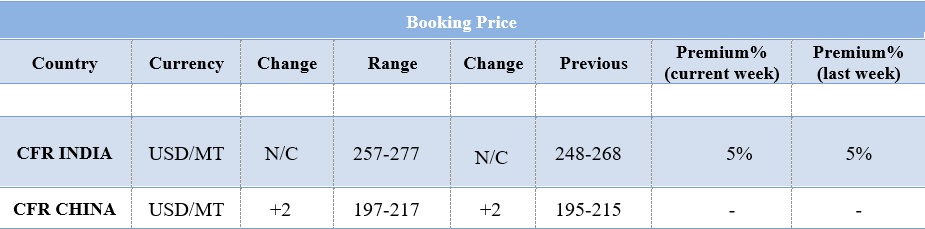

BOOKING SCENARO

INDIA & INTERNATIONAL

- This week domestic market prices of Methanol remained weak and there was slight decline in domestic values. Prices were assessed in the range of Rs.21-22/Kg.

- Prices for India were assessed around USD 267/MT, with no change ion values for this week. CFR China prices were assessed around USD 207/MT for this week.

- On other side CFR SEA prices were assessed in the range of USD 210/MT. Methanol the main product of Indian market has now increased its reach and the amount of import has also increased. Last two months’ average import was of 85% of last year imports. Still heavy stock is available at Indian ports.

- The paint industry and laminate industries has now started their work and has also improved the consumption of methanol.

- There has been improvement in demand of petrochemicals in India market past few weeks. The rise has been in particular due to beginning of festive season across the nation. Next week there will be starting of Navratri festival which will further boost the demand for chemicals like Acetic Acid, vinyl acetate monomer, acrylonitrile, and styrene. Most of the households make changes in their houses or make heavy purchase in this festive season.

- Indian government is working hard to provide more relaxations and financial help to the industry to overcome the adversities of pandemic. The steps include advance payment of a part of the wages of central government employees and allowing government employees to spend tax-exempt travel allowances on goods and services. All these measures are likely to create an additional demand of 730 billion rupees ($10bn).

- The Indian government will shore up investment by spending extra rupee (Rs) 250bn on roads, ports and defense projects, and offering Rs120bn rupees in interest-free 50-year loans to state governments for spending on infrastructure before 31 March 2021.

- The other major issue hurting Indian government is the over increasing number of Covid cases. Number of cases are expected to increase more and likely to exceed those in the US in the next few weeks given the rapid surge in infections in the past two months - 3m cases in September and 2m in August.

- The Reserve Bank of India kept its policy repurchase (repo) rate unchanged at 4.0% on 9 October, in line with market expectations and the second time that the central bank has kept its rates unchanged following the 40 basis points cut on 22 May this year.

- The emerging market giant is hurting from continued spikes in coronavirus infections - which constrain domestic economic activity - and a lacklustre external environment.

- China based Yankuang Guohong Chemical has shut down its Methanol unit abruptly for maintenance. The operation were facing some technical glitch as a result the operations were called off. Unit is based at Shandong province of China and has the production capacity of 5,00,000 tonne/year.

$1 = Rs. 73.34

Import Custom Ex. Rate USD/ INR: 74.25

Export Custom Ex. Rate USD/ INR: 72.55