Vinyl Acetate Monomer Weekly Report 3 June 2017

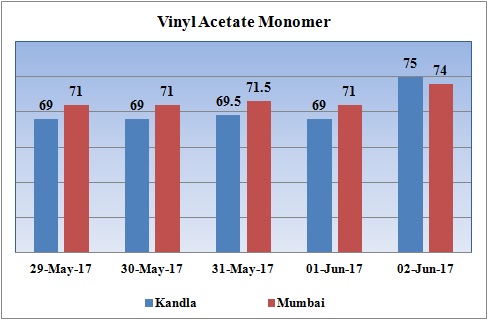

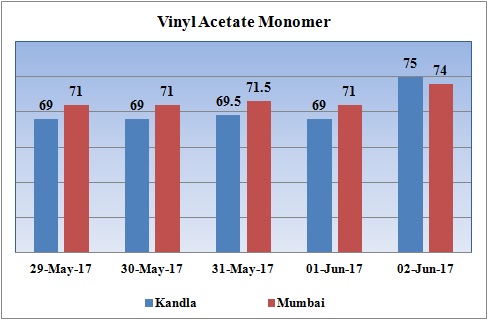

Weekly Price Trend: 29-05-2017 to 02-06-2017

- The graph above focuses on the Vinyl Acetate Monomer price trend for the current week.

- VAM prices followed a mixed trend throughout this week. In compare to other petrochemicals there has been slowdown in domestic values for VAM throughout this week.

- By end of the week prices were assessed around Rs.75/Kg for Kandla port and Rs.74/Kg for Mumbai port.

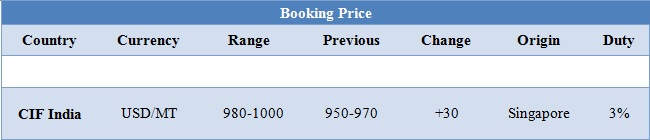

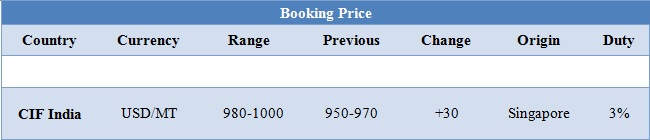

Booking Scenario

The above chart shows the international prices for Vinyl Acetate Monomer. International prices of VAM increased heavily for this week in compare to last Friday’s assessed level.

INDIA & INTERNATIONAL

- VAM prices were assessed at the level of Rs.75/Kg at Kandla and Rs.74/Kg with an heavy increase in domestic prices.

- On other side, CFR India values again increased for this week. Prices were assessed in the range of USD 980-1000/MTS, with an increase of USD 30/MTS in compare to last week’s closing values.

- Saudi International Petrochemical Company has announced the periodic maintenance for its Vinyl Acetate Monomer unit of the International Vinyl Acetate Company (IVC). The plant was shut down on 30th May and is likely to remain off-stream for around three weeks. During this maintenance all the efforts would be made to increase the efficiency and reliability. The necessary precautions have been taken to ensure that commitments to customers are met without interruption during this period. Sipchem shall make further announcements in relation to the scheduled Turnaround maintenance as appropriate.

- This week oil prices remained highly volatile. With a firm decision taken last week by OPEC, Russia and other producers to extend their agreement to curb output by 1.8 million barrels a day for another nine months, in order to rebalance the oil market, the bearish tone in the oil sector resurfaced.

- According to reports, U.S. oil supplies dropped by 6.4 million barrels last week, a positive for the market and a much bigger decline than expected.

- On Thursday U.S. crude up slightly after a larger-than-expected domestic inventory drawdown.

- Closing crude values on Thursdayincreased.WTI on NYME closed at $48.36/bbl, prices have increased by $0.04/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.02/bbl in compared to last trading and was assessed around $50.33/bbl.

- As per market report, U.S. production increased, and the expectation is that ongoing activity in U.S. shale will continue to boost output, offsetting OPEC efforts.

$1 = Rs. 64.44

Import Custom Ex. Rate USD/ INR: 65.35

Export Custom Ex. Rate USD/ INR: 63.70