Vinyl Acetate Monomer Weekly Report 16 Dec 2017

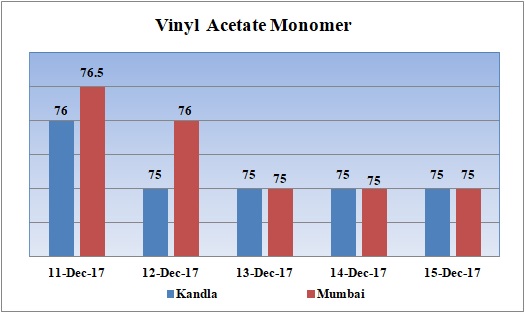

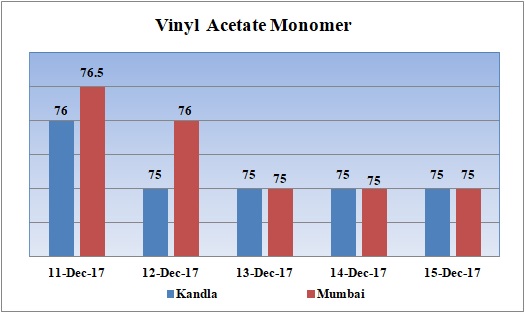

Weekly Price Trend: 11-12-2017 to 15-12-2017

- The graph above focuses on the Vinyl Acetate Monomer price trend for the current week.

- There has been no change in domestic values for VAM. By end of the week prices were assessed around Rs.76/Kg for Kandla port and Rs.76.5/Kg for Mumbai port.

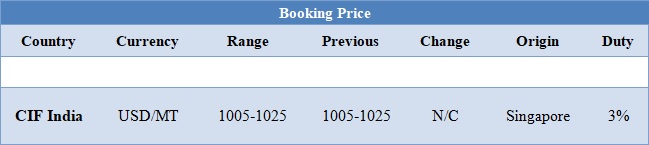

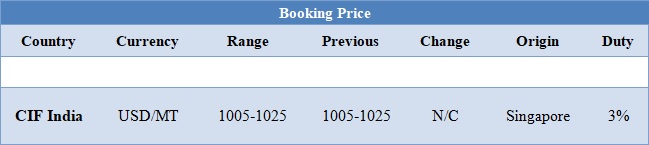

Booking Scenario

The above chart shows the international prices for Vinyl Acetate Monomer. International prices of VAM reduced heavily for this week in compare to last Friday’s assessed level.

INDIA & INTERNATIONAL

- VAM prices were assessed at the level of Rs.75/Kg at Kandla and for Mumbai port for bulk quantity.

- On other side, CFR India values remained stable for this week. Prices were assessed in the range of USD 1005-1025/MTS, with no change in compare to last week’s closing values.

- On other side there has been rise in values in Acetic Acid market. Prices were assessed in the range of USD 640-660/MTS.

- This week crude oil prices have followed mixed trend. On Thursday oil prices rose as a pipeline outage in Britain continued to support prices despite forecasts showing global crude surplus in the beginning of next year.

- On Thursday, closing crude values have increased. WTI on NYME closed at $57.04/bbl; prices have increased by $0.44/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.87/bbl in compared to last trading and was assessed around $63.31/bbl.

- While on Friday, Oil markets were stable as the Forties pipeline outage in the North Sea and the ongoing OPEC-led production cuts supported prices, while rising output from the United States kept crude from rising further.

- Traders said markets were overall well supported by efforts led by OPEC and Russia to withhold supply to prop up prices.

- As per market report, the oil market to have a surplus of 200,000 barrels per day in the first half of next year before reverting to a deficit of about 200,000 bpd in the second half. That means 2018 overall should show closely balanced market.

$1 = Rs. 64.04

Import Custom Ex. Rate USD/ INR: 65.40

Export Custom Ex. Rate USD/ INR: 63.70