Vinyl Acetate Monomer Weekly Report 13 Jan 2018

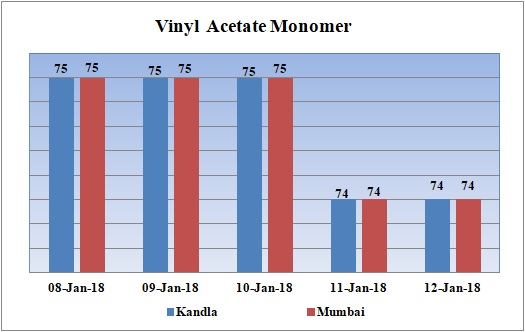

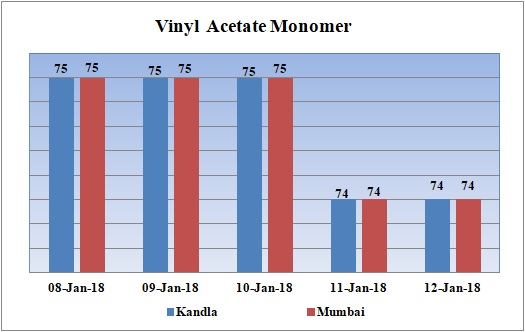

Weekly Price Trend: 08-01-2018 to 12-01-2018

- The graph above focuses on the Vinyl Acetate Monomer price trend for the current week.

- There has been slow down in domestic values for VAM. By end of the week prices were assessed around Rs.74/Kg for Kandla port and for Mumbai port.

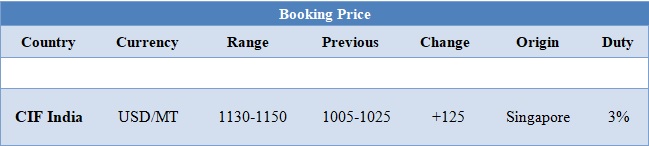

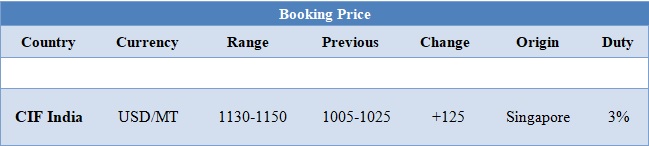

Booking Scenario

The above chart shows the international prices for Vinyl Acetate Monomer. International prices of VAM remained stable for this week in compare to last Friday’s assessed level.

INDIA & INTERNATIONAL

- VAM prices were assessed at the level of Rs.74/Kg at Kandla and for Mumbai port for bulk quantity.

- On other side, CFR India values have increased for this week. Prices were assessed in the range of USD 1130-1150/MTS, with an increase of USD 125/MTS in compare to last week’s closing values.

- On other side there has been significant hike in values in Acetic Acid market. Prices were assessed in the range of USD 680-700/MTS.

- This hike has been basically due to limited supply of chemical from China. VAM prices have increased heavily in China market. Prices for VAM increased by more than 500 yuan in one week. The limited supply due to transportation issues as major snowfall is being experienced in central and eastern China provinces.

- Major producers based in northern part of China have cut down their production due to lack of supply of feedstock Acetic Acid. Sinopec Chongqing SVW Chemicals has shut down their VAM unit in last week of December. This unit is one of the major suppliers of VAM in the country. The unit is expected to go on stream by January end. Unit has the production capacity of 5,00,000 tonnes/year.

- Acetic Acid prices have also increased heavily in China. It has increased by more than 25% in last two months. Heavy snowfall along with disrupted transportation facilities has put an halt on the supply of petrochemical industry.

- Demand is likely to gain more momentum after Lunar vacation in China as supply will be more weak and dull. After the Lunar vacation the other major producer Sinopec Great Wall Energy and Chemical’s unit is likely to shut down its VAM unit for maintenance.

$1 = Rs. 63.61

Import Custom Ex. Rate USD/ INR: 64.50

Export Custom Ex. Rate USD/ INR: 62.80