Vinyl Acetate Monomer Weekly Report 08 Sep 2018

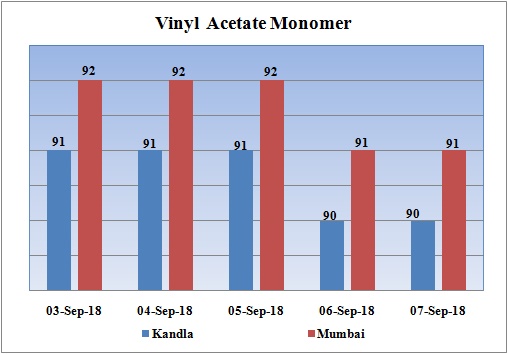

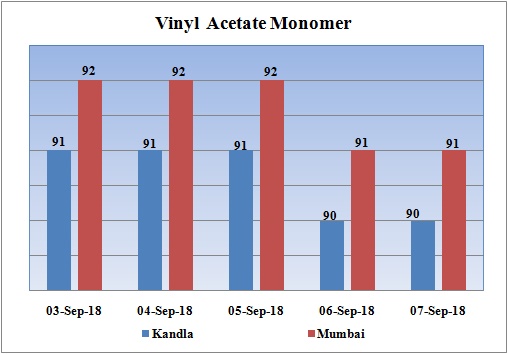

Weekly Price Trend: 03-09-2018 to 07-09-2018

- The graph above focuses on the Vinyl Acetate Monomer price trend for the current week.

- There has been slowdown in values as prices continue to fluctuate throughout this week. The impact of increase in Acetic Acid prices has now reduced and prices are no ore under its influence.

- By end of the week prices were assessed around Rs.91/Kg for Mumbai port Rs. 90/Kg for Kandla port.

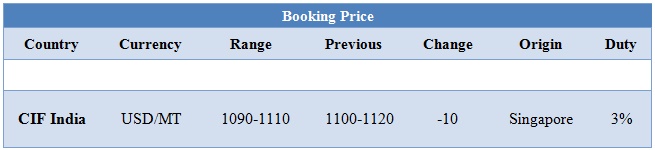

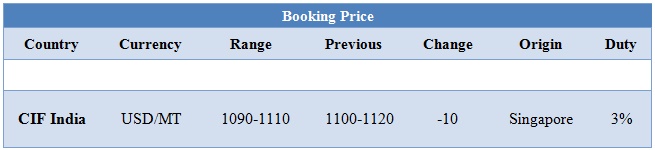

Booking Scenario

The above chart shows the international prices for Vinyl Acetate Monomer. International prices of VAM reduced heavily for this week. VAM with zero duty was available at USD 1100/MT in for traders.

INDIA & INTERNATIONAL

- VAM prices were assessed at the level of Rs.91/Kg at Kandla and Rs.92/Kg for Mumbai port bulk quantity.

- With correction of Acetic Acid prices, there has been correction in the values for VAM. Generally demand for VAM remained silent in the monsoon season in India. VAM is primarily used in manufacturing of paints, adhesives, and paper coatings. Now with arrival of festive season in next few weeks demand for such products will increase in domestic market.

- It is also used in packaging industry. The demand for packaged food and air tight and eco friendly packaging has increased by many folds in past few years. There has been significant slowdown in Acetic Acid values in international market. This will put an additional pressure in the demand for VAM in the packaging industry.

- There has been continuous depreciation of Indian currency against dollar. The impact is due to rise in crude values in international market. To deepen the sorrows the sanction against Iran by US further hammered the currency rate of many nations. Turkey is on the verge of failing of economy. This in turn has led to increase in petrochemical prices and crude values.

- There has been continuous soaring in crude prices in this week. The US inventories have fell to their lowest levels since February 2015. US West Texas Intermediate (WTI) crude futures were at $67.90 per barrel at 0056 GMT, up 13 cents, or 0.2 per cent, from their last settlement. International Brent crude futures climbed 12 cents, or 0.2 per cent, to $76.62 a barrel. With release of Oil inventory data last night, a large number has been drawn from crude inventories.

- Global oil markets have tightened over the last month, pushing up Brent prices by more than 10 per cent since the middle of August. Investors anticipate less supply from Iran as US sanctions on Tehran begin to bite.

- With ship-tracking data now pointing at a reduction in Iranian exports, renewed strife in Libya, and Venezuelan export availability hobbled by an accident at the key Jose terminal, the list of bullish headlines is getting longer,” said Michael Dei-Michei, head of research at Vienna consultancy JBC Energy.

- US is quite actively tracking the flow of crude and has managed to use its sanctions very actively against Iran. They are forcing many western companies to cease export from Iran and avoid trading with them.

- Contrary to this India and China are making efforts to continue their imports from using one or other way. Global oil markets have tightened over the last month, pushing up Brent prices by more than 10 per cent since the middle of August. Investors anticipate less supply from Iran as US sanctions on Tehran begin to bite.

$1 = Rs. 71.73

Import Custom Ex. Rate USD/ INR: 71.10

Export Custom Ex. Rate USD/ INR: 69.40