Toluene Weekly Report 7 August 2020

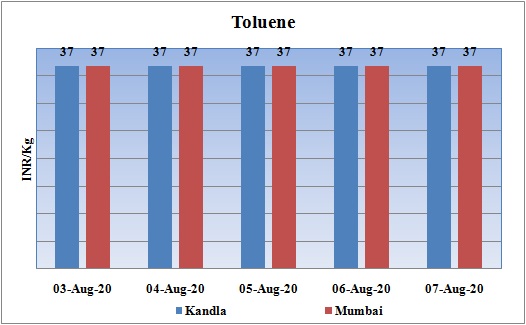

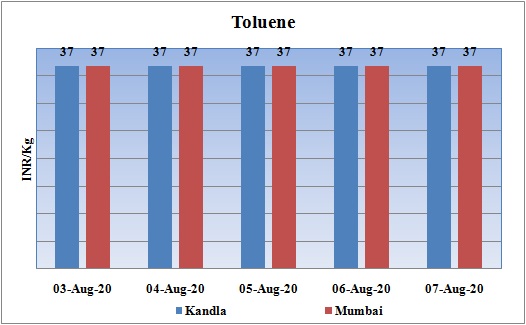

Weekly Price Trend: 03-08-2020 to 07-08-2020

- The above given graph focuses on the Toluene price trend for current week. There has been slight improvement in domestic values for Toluene.

- This week prices remained stable for most of the week with slight decline by end of the week. Prices were assessed at the level of Rs.37/Kg for Kandla and for Mumbai port. Prices increased by Rs.1/Kg for this week.

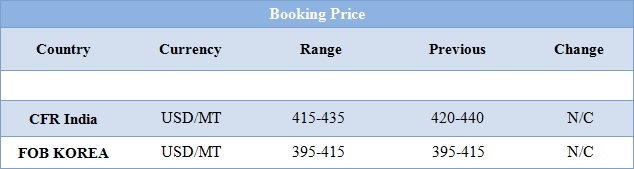

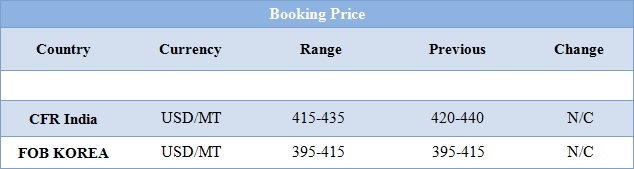

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic market price was assessed at Rs.37/kg for bulk quantity for Kandla and for Mumbai port. Domestic prices slightly improved for this week.

- CFR India prices were evaluated at USD 415-435/MT for this week. FOB Korea values for Toluene was assessed around USD 495-515/MT for this week. There has been no change in international prices for this week.

- CFR China price of toluene were assessed at the level of USD 414/MT for this week slightly corrected by USD 9/MTS for this week. While CFR SEA prices for this week were assessed around USD 440/MT.

- FOB Korea values for Benzene were assessed around USD 440/MT for this week. There has been a fall of USD 10/MT in Benzene values. CFR China prices were assessed at the level of USD 445MT for this week.

- There has been heavy rains in the western part of India specifically Mumbai which has halted all the port as well as other operations.

- Covid cases are highest in India in Mumbai which has made led to strong melting in petroleum industry.

- With starting of festive season there will be more holidays in the industry. However demand will not gain in spite of festive season. Manufacturers are facing really very difficult time due to this pandemic.

- Oil prices slipped further leading to the decline in fuel demand growth amid a resurgence of coronavirus cases and as talks have stalled in the United States on a new stimulus deal.

- The resurgence of coronavirus infections remains the main uncertainty in the oil market, as that will determine how fast fuel demand rebounds.

- Rising cases are the main reason for the uncertainty for fuel demand growth and in oil prices.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $41.95/bbl. Prices have decreased by 0.24/bbl in compared to last closing prices. While Brent on Inter Continental Exchange have decreased by 0.08/bbl in compare to last closing price and was assessed around $45.09/bbl.

$ 1 = Rs. 74.87

Import Custom Ex. Rate USD/ INR: 76.10

Export Custom Ex. Rate USD/ INR: 74.40