Toluene Weekly Report 3 July 2020

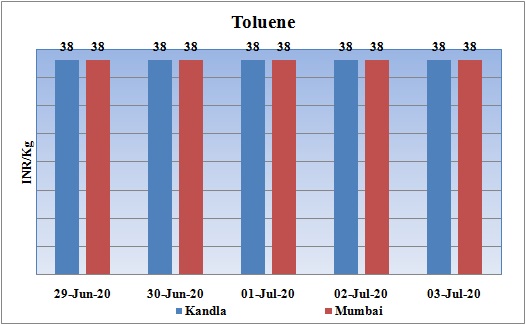

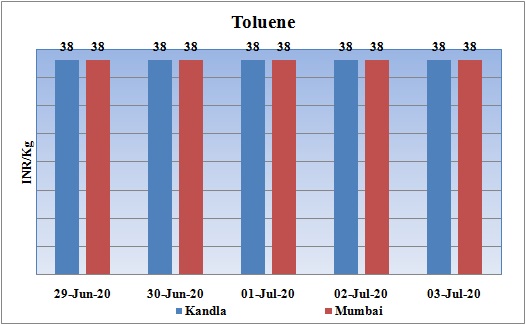

Weekly Price Trend: 29-06-2020 to 03-07-2020

- The above given graph focuses on the Toluene price trend for current week. There has been rise in the prices for this week.

- This week prices increased for this week. Prices were assessed at the level of Rs.38/Kg for Kandla and for Mumbai port. Prices remained unchanged for this week.

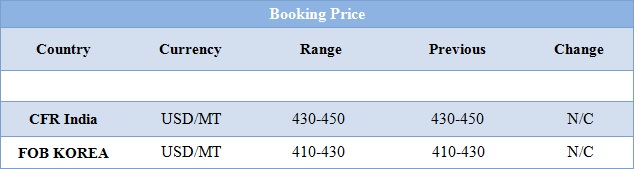

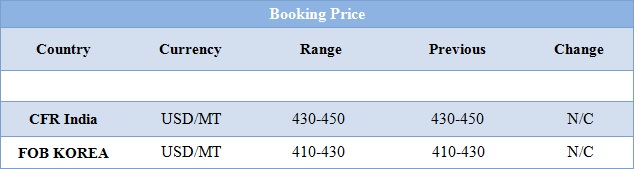

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic market price was assessed at Rs.38/kg for bulk quantity for Kandla and for Mumbai port. Domestic prices remained unchanged for this week.

- CFR India prices were evaluated at USD 430-450/MT for this week. FOB Korea values for Toluene was assessed around USD 410-430/MT for this week. There has been no change in international prices for this week.

- CFR China price of toluene were assessed at the level of USD 435/MT for this week. While CFR SEA prices for this week were assessed around USD 430/MT.

- FOB Korea values for Benzene were assessed around USD 418/MT for this week. There has been slight decline of USD 2/MT in Benzene values for this week. CFR China prices were assessed at the level of USD 419/MT for this week.

- There has been continuous surge in Corona cases in major cities of India. The financial city of India Mumbai has been hotspot for the pandemic. The state government over there has declared complete lockdown again for two weeks. Operations are likely to get setback due to this lockdown.

- The face-off between India and China has been major concern for global petrochemical market. India this week has banned the apps and is focusing more on Make in India rather importing from China. The tensions has been escalating day by day where China has been conquering the lands in south Asia and creating tensions with neighboring countries.

- Oil declines as there has been rise in corona cases which worries oil demand. Prices decline as the resurrection of the coronavirus globally and in the United States, the world's largest oil consumer, dimmed the prospects of fuel demand recovery.

- Increases in the daily cases of the coronavirus, and globally as well has pressured prices. New U.S. COVID-19 cases rose by more than 50,000 on Thursday, setting a record for a third consecutive day.

- On Thursday, closing crude values have increased. WTI on NYME closed at $40.65/bbl. Prices have increased by 0.83/bbl in compared to last closing prices. While Brent on Inter Continental Exchange is increased by 1.11/bbl in compare to last closing price and was assessed around $43.14/bbl.

- The market has become increasingly confident that easing restrictions on travel and business would boost demand for crude oil, but the pandemic's progress threatens to derail this recovery.

- China’s petrochemical markets mainly tracked crude oil in June with several chemicals saw lower prices as a result of weaker demand, a trend likely to continue months ahead.

- As of now, 19 out of the 33 petrochemical products witnessed lower prices than at the beginning of the month while for the rest, almost a half saw limited price gains.

- These include methanol, purified terephthalic acid (PTA), polypropylene (PP), polyethylene (PE), monoethylene glycol (MEG), mixed xylene, benzene, toluene, acetic acid, styrene, phenol, acrylonitrile, acetone, n-butanol, 2-ethylhexanol (2-EH), acrylic esters and propylene oxide (PO).

$ 1 = Rs. 74.63

Import Custom Ex. Rate USD/ INR: 76.40

Export Custom Ex. Rate USD/ INR: 74.70