Toluene Weekly Report 29 May 2020

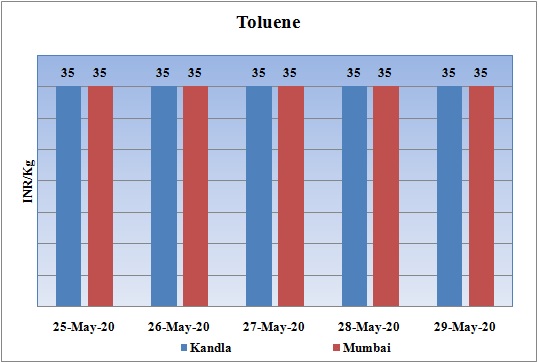

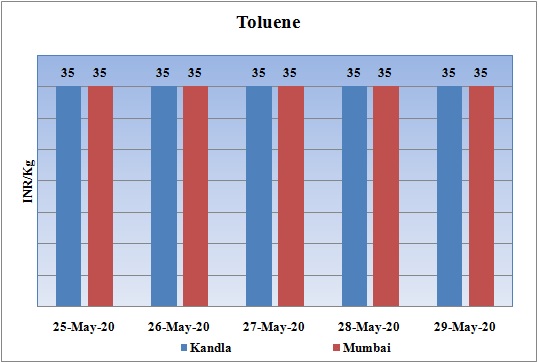

Weekly Price Trend: 25-05-2020 to 29-05-2020

- The above given graph focuses on the Toluene price trend for current week. There has been rise in the prices for this week.

- This week prices increased lightly for this week. Prices were assessed at the level of Rs.36/Kg for Kandla and for Mumbai port. Prices were improved by Rs.2/Kg for this week for bulk quantity.

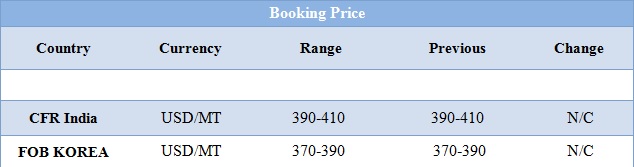

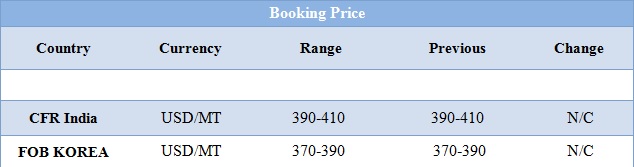

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic market price was assessed at Rs.36/kg for bulk quantity for Kandla and for Mumbai port. Domestic prices increased slightly for this week.

- CFR India prices were evaluated at USD 390-410/MT for this week. FOB Korea values for Toluene was assessed around USD 370-390/MT for this week. There has been fluctuation of USD 5/MT throughout this week in the international for Toluene.

- CFR China price of toluene were assessed at the level of USD 420/MT for this week. While CFR SEA prices for this week were assessed around USD 400/MT.

- FOB Korea values for Benzene were assessed around USD 405/MT for this week. There has been heavy stability in Benzene values for this week. The outbreak in prices of crude has affected whole of the petrochemical market. CFR China prices were assessed at the level of USD 415/MT for this week.

- All the global trends are making difficult for the survival developing nations. Already brutally affected by COVID. The growing tension between India and China over border issues, worsening of China and US terms has been adding to difficult times ahead for the world.

- Dow also wants more clarity on US-China trade relations before pursuing larger projects. European chemicals stocks and bourses rose healthily on Thursday on the back of hopes the lockdown easings will revive economic activity and liquidity provided by central banks will soften the recession.

- The rally needs a breather. It has been four weeks of gains and the market needs to buy time for downstream prices to catch up. Thursday’s data from the Energy Information Administration showed that U.S.crude oil and distillate inventories rose sharply last week. Fuel demand remained slack even as various states lifted travel restrictions they had imposed to curb the coronavirus pandemic, analysts said.

- On other side Saudi Arabia and some OPEC members are considering extending record production cuts of 9.7 million barrels per day beyond June, but have yet to win support from Russia.

- On Thursday, closing crude values have increased. WTI on NYME closed at $33.71/bbl. Prices have increased by 0.90/bbl in compared to last closing prices. While Brent on Inter Continental Exchange is increased by 0.55/bbl in compare to last closing price and was assessed around $35.29/bbl.

$ 1 = Rs. 75.62

Import Custom Ex. Rate USD/ INR: 76.60

Export Custom Ex. Rate USD/ INR: 74.90