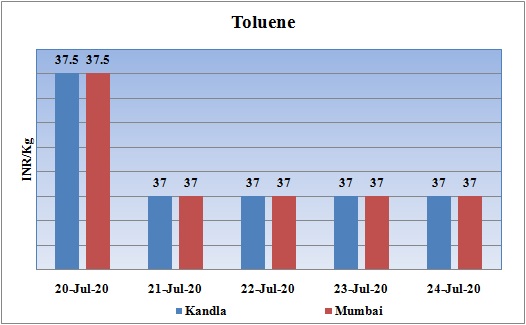

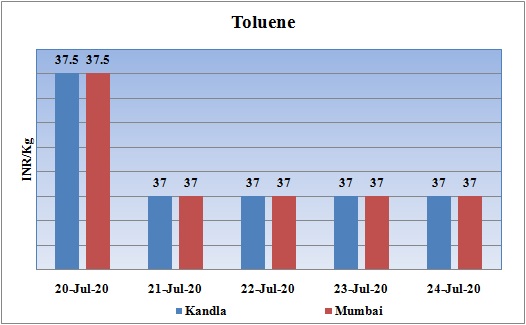

Toluene Weekly Report 24 July 2020

Weekly Price Trend: 20-07-2020 to 24-07-2020

- The above given graph focuses on the Toluene price trend for current week. There has been decline in domestic values for Toluene.

- This week prices reduced slightly initially in the inception of the week itself. Prices were assessed at the level of Rs.37/Kg for Kandla and for Mumbai port. Prices reduced by Rs.1/Kg for this week.

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic market price was assessed at Rs.37/kg for bulk quantity for Kandla and for Mumbai port. Domestic prices slightly reduced for this week.

- CFR India prices were evaluated at USD 420-440/MT for this week. FOB Korea values for Toluene was assessed around USD 400-420/MT for this week. There has been no change in prices for this week.

- CFR China price of toluene were assessed at the level of USD 427/MT for this week slightly corrected by USD 3/MTS for this week. While CFR SEA prices for this week were assessed around USD 425/MT.

- FOB Korea values for Benzene were assessed around USD 435/MT for this week. There has been a rise of USD 20/MT in Benzene values. CFR China prices were assessed at the level of USD 435MT for this week.

- Petrochemical market has been through difficult conditions. The scenario is likely to continue for the second half of the year as well. The demand is likely to remain lull as major economies of the world are struggling with this pandemic. The ongoing tension between America and China has been the major concern.

- Chinese firms are facing tough time as most of the countries blame China for the rise of this pandemic. Covid 19 was first observed in Chinese province Wuhan. This pandemic has stalled all the major economies of the world.

- The petrochemical products are finding difficult to be absorbed as major industries are operating at slow rate. Still the operation activity of firms has not gain its complete momentum due to lack of labor.

- The stocks of chemicals are piling up and inventories are rising up. This was apparent as major Chinese polyester producers embarked on production cut, reckoning an inevitable move due to constricted margins and poor sales.

$ 1 = Rs. 74.23

Import Custom Ex. Rate USD/ INR: 76.10

Export Custom Ex. Rate USD/ INR: 74.40