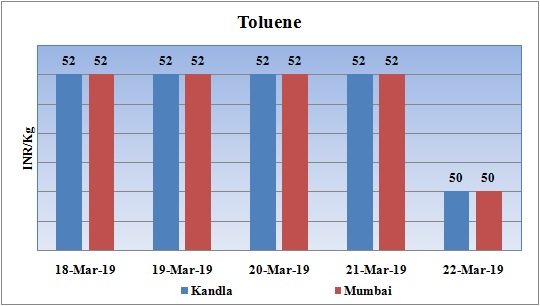

Toluene Weekly Report 22 March 2019

Weekly Price Trend: 18-03-2019 to 22-03-2019

- The above given graph focuses on the Toluene price trend for current week.

- This week prices remained soft-and there has been decline in values. By the end of the week domestic prices were assessed at Rs.50/Kg for bulk quantity for Kandla and for Mumbai ports of India.

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market price was assessed at Rs.52/kg for most of the week but by closing of the day prices reduced of the level of Rs.50/Kg for bulk quantity.

- CFR India prices were evaluated at USD 660/MT, slightly improved by USD 10/MTS for this week.

- CFR China price of toluene were assessed at the level of USD 685/MT, increased by USD 10/MT for this week. On other side FOB Korea prices were evaluated at USD 650/MT, slightly improved by USD5/MT for this week.

- CFR south East Asia price were evaluated at USD 695/MT.

- Benzene FOB Korea prices has also improved for this week. FOB Korea values were assessed around USD 625/MT. On other side CFR China prices for Benzene were assessed USD 619/MT for this week.

- Indian currency has also strengthened against dollar in last few weeks. This has been one of the strongest performances of rupee against dollar since last few years.

- Crude prices continued its rally for this week. The oversupply of crude is no more in United States but it will not have major impact on prices.

- Many analysts and market observers believe that oil prices will move much higher with OPEC+ production cuts, declining U.S. inventories and a relatively strong global economy assuming that U.S.-China trade talks have a happy ending.

- Now Iranian customers have also started negotiating with the U.S. on possible waiver extensions to continue buying oil from Tehran.

- The U.S. waivers for eight key Iranian oil customers, including China, India, Japan, and South Korea, will expire in early May. While the U.S. Administration says that it continues to pursue zero Iranian oil exports, analysts expect Washington to extend waivers to at least a few of the currently exempted buyers, with reduced volumes allowed under the new waivers, as the Administration wouldn’t want to push oil prices too high.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $59.98/bbl. Prices have decreased by $0.25/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.64/bbl in compare to last closing price and was assessed around $67.86/bbl.

$ 1 = Rs. 68.95

Import Custom Ex. Rate USD/ INR: 70.00

Export Custom Ex. Rate USD/ INR: 68.35