Toluene Weekly Report 20 June 2019

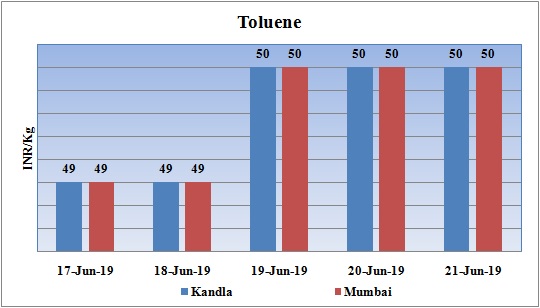

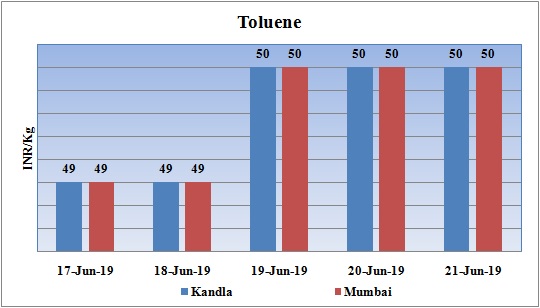

Weekly Price Trend: 17-06-2019 to 21-06-2019

- The above given graph focuses on the Toluene price trend for current week.

- This week prices has improved slightly and by end of the week prices were increased by Rs.1/Kg in compare to last week’s closing values and were assessed at the level of Rs.50/Kg for bulk quantity for Kandla and for Mumbai ports of India.

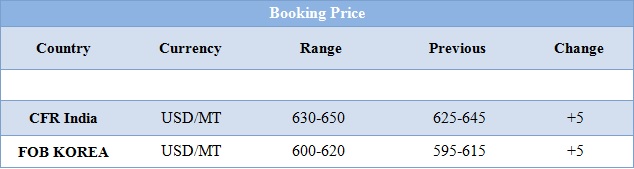

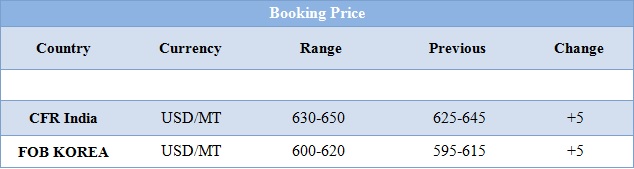

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market price was assessed at Rs.50/kg for bulk quantity, increased by Rs.1/Kg for bulk quantity.

- CFR India prices were evaluated at USD 640/MT, increased by USD 5/MTS for this week.

- CFR China price of toluene were assessed at the level of USD 630/MT, increased by USD 5/MT for this week. On other side FOB Korea prices were evaluated at USD 610/MT, increased by USD 5/MT for this week.

- CFR south East Asia price were evaluated at USD 630/MT, increased by USD 20/MT for this week.

- Benzene the major source for aromatic products has also improved for this week. FOB Korea values for Benzene were assessed around USD 635/MT, increased by USD 20/MT for this week. CFR China prices also increased for this week. Prices were assessed at the level of USD 620MT for this week.

- Severed tension between Iran and US has resulted in the soaring of crude values in international market. In the early hours on Thursday, Iran shot down a U.S. drone, with both sides reporting conflicting accounts. The U.S. says the drone was in international waters, while Iran says that the drone had entered Iranian air space. The incident adds to the boiling cauldron of tension between the two countries.

- In early trading on Thursday, WTI was up more than 4 percent and Brent was up more than 3 percent, surging to the highest level since late May.

- The confused policy of US against Iran has been the talk of town. With no proper reasons US has been escalating the tension and has been prompting Iran to take any major negative step.

- The rapid spike in tension has only moved crude oil prices in fits and starts over the last few weeks. The prospect of a major war, and the potential disruption to maritime trade in the Persian Gulf, was largely shrugged off by oil traders.

$ 1 = Rs. 69.55

Import Custom Ex. Rate USD/ INR: 70.40

Export Custom Ex. Rate USD/ INR: 68.70