Toluene Weekly Report 19 June 2020

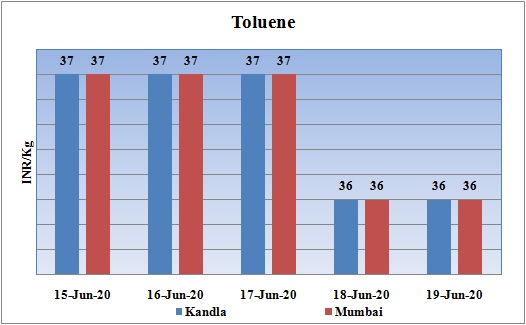

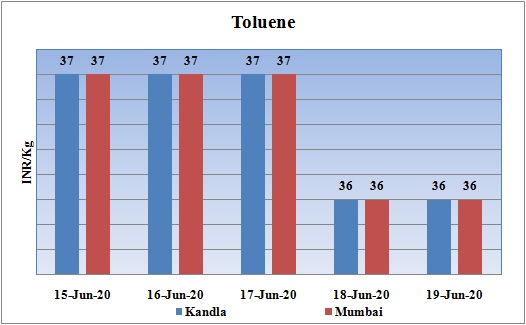

Weekly Price Trend: 15-06-2020 to 19-06-2020

- The above given graph focuses on the Toluene price trend for current week. There has been rise in the prices for this week.

- This week prices reduced significantly for this week. Prices were assessed at the level of Rs.36/Kg for Kandla and for Mumbai port. Prices were reduced by Rs.4/Kg for this week for bulk quantity.

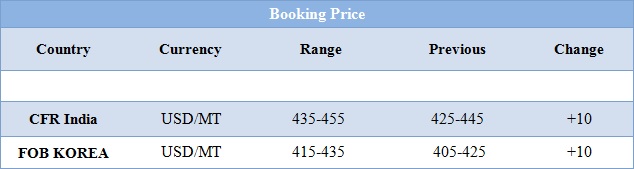

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic market price was assessed at Rs.36/kg for bulk quantity for Kandla and for Mumbai port. Domestic prices increased slightly for this week.

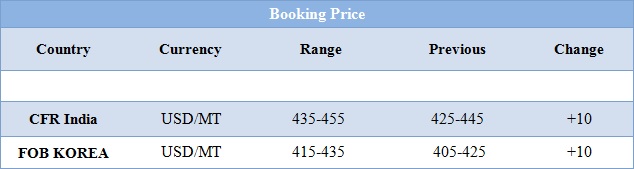

- CFR India prices were evaluated at USD 435-455/MT for this week. FOB Korea values for Toluene was assessed around USD 415-435/MT for this week. There has been rise of USD/MT in international prices for Toluene.

- CFR China price of toluene were assessed at the level of USD 440/MT for this week. While CFR SEA prices for this week were assessed around USD 435/MT.

- FOB Korea values for Benzene were assessed around USD 425/MT for this week. There has been decline of USD 10/MT in Benzene values for this week. The outbreak in prices of crude has affected whole of the petrochemical market. CFR China prices were assessed at the level of USD 430/MT for this week.

- There has been big slump in crude prices for this week. Oil prices crashed by 7 percent on Thursday, after the EIA reported on Wednesday.

- On Wednesday, closing crude values have decreased. WTI on NYME closed at $37.96/bbl. Prices have decreased by 0.42/bbl in compared to last closing prices. While Brent on Inter Continental Exchange is decreased by 0.25/bbl in compare to last closing price and was assessed around $40.71/bbl.

- Fears of a second wave of coronavirus pandemic and escalating global geopolitical tensions continue to support gold’s haven demand. Meanwhile, hopes of a quick economic recovery and a steady dollar are likely to limit major upsides.

- The face-off between India and China has been the talk of discussion throughout this week.

- The tight situation on the borders has affected the peace among two nations and the situation is likely to last for a while.

- China is one of the biggest exporters of petrochemical to India. If tensions continued then there will be major impact on petrochemical imports from China.

- Asian petrochemical lowered heavily while oil prices declined on Monday over revival of news cases and fears of a second coronavirus wave in view of recent spikes in the US and China.

- "US COVID-19 remains on the radar as infection cases topped 2mln while many states in US like Texas, Arizona, Florida, North Carolina, are experiencing rising COVID-19 infection increasing ICU utilization, even as the states are undertaking plans to reopen their economies," Singapore-based UOB Global Economics & Markets Research said.

- Global cases of the coronavirus are approaching 8m, with India's cases surpassing 300,000 on Sunday, according to latest World Health Organization (WHO) data.

- China on 13 June imposed lockdowns in parts of Beijing following evidence of a new virus cluster at one of its districts.

- All the economies around the world are worried and are under great pressure due to Covid 19.

- Asian petrochemical lowered heavily while oil prices declined on Monday over revival of news cases and fears of a second coronavirus wave in view of recent spikes in the US and China.

- "US COVID-19 remains on the radar as infection cases topped 2mln while many states in US like Texas, Arizona, Florida, North Carolina, are experiencing rising COVID-19 infection increasing ICU utilization, even as the states are undertaking plans to reopen their economies," Singapore-based UOB Global Economics & Markets Research said.

- Global cases of the coronavirus are approaching 8m, with India's cases surpassing 300,000 on Sunday, according to latest World Health Organization (WHO) data.

- China on 13 June imposed lockdowns in parts of Beijing following evidence of a new virus cluster at one of its districts.

- All the economies around the world are worried and are under great pressure due to Covid 19.

$ 1 = Rs. 76.10

Import Custom Ex. Rate USD/ INR: 77.05

Export Custom Ex. Rate USD/ INR: 75.35