Toluene Weekly Report 16 August 2019

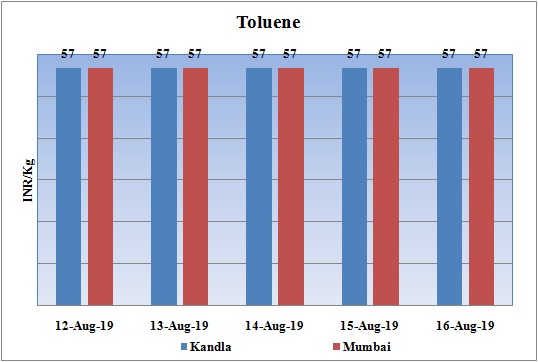

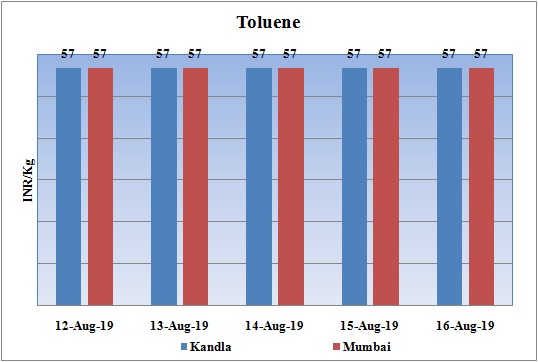

Weekly Price Trend: 12-08-2019 to 16-08-2019

- The above given graph focuses on the Toluene price trend for current week.

- This week prices remained firm throughout this week. By end of the week prices were assessed at the level of Rs.57/Kg for bulk quantity for Kandla and for Mumbai ports of India.

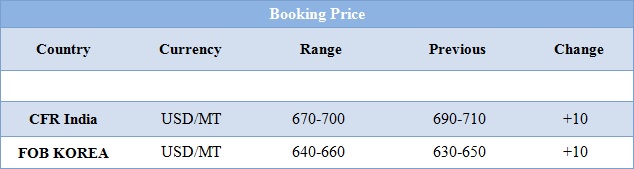

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic market price was assessed at Rs.57/kg for bulk quantity remained unchanged in compare to last week’s closing values.

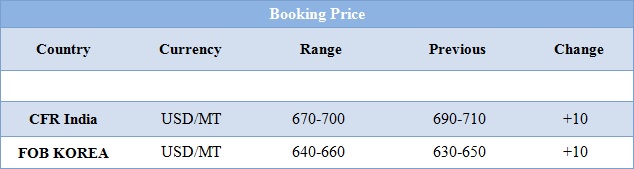

- CFR India prices were evaluated at USD 680/MT, increased by USD 10/MT for this week.

- CFR China price of toluene were assessed at the level of USD 670/MT, increased by USD 10/MT values for this week. On other side FOB Korea prices were evaluated at USD 650/MT, increased by USD 10/MTS for this week.

- CFR south East Asia price were evaluated at USD 685/MT, reduced by USD 15/MT for this week.

- The ongoing tensions between India and neighboring state have been a matter of concern. The neighboring state has cut down its all ties with India. Although this will not have major impact on India economy.

- India’s nine-month long demand slump in automobile industry - July sales dipping to its lowest level in 20 years - has affected the auto components and ancillary industries including petrochemicals triggering job cuts and production slowdown. This slowdown in the auto industry is also being reflected in the ancillary industries, which includes the chemicals and plastics segments.

- Leading Indian paints manufacturers Asian Paints and Berger Paints have noted a downward pressure on their automotive paints segment due to the slowdown.

- Paint manufacturers use crude oil derivatives such as titanium dioxide, ethylene glycol and plasticizers as raw materials.

- Chemicals, technical textiles and engineering plastics manufacturer SRF Ltd has seen a 11% decline in sales in its technical textiles segment in the first quarter of 2019-20 and expects the subdued demand from the automotive industry to continue in the near term, a company source said.

- The slowdown in the auto industry has also affected the demand for phenol-based derivatives, said Deepak Mehta, chief managing director of chemicals manufacturer Deepak Nitrite while reviewing the company’s first quarter results.

$ 1 = Rs. 71.55

Import Custom Ex. Rate USD/ INR: 71.85

Export Custom Ex. Rate USD/ INR: 70.15