Toluene Weekly Report 1 Feb 2019

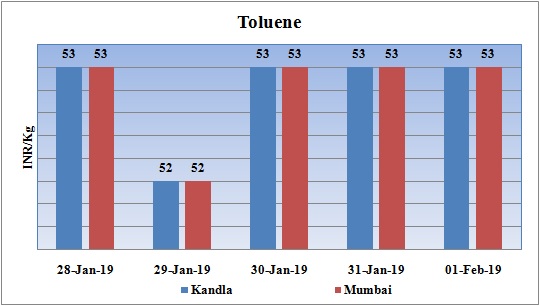

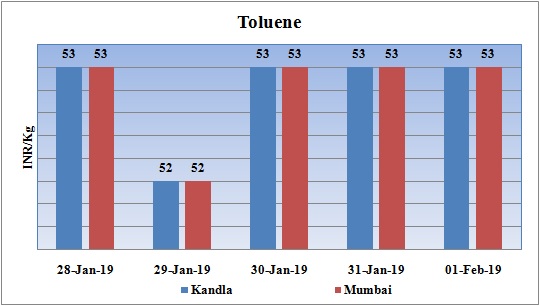

Weekly Price Trend: 28-01-2019 to 01-02-2019

- The above given graph focuses on the Toluene price trend for current week

- This week prices remained firm and there has been rise in values past few weeks.

- By the end of the week domestic prices were assessed at Rs.53/Kg for bulk quantity for Kandla and for Mumbai ports of India.

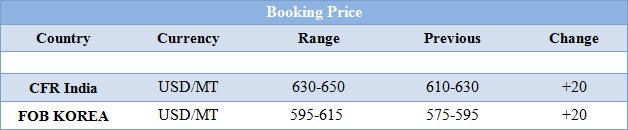

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market price was assessed at Rs.53/kg for Kandla and for Mumbai ports of India.

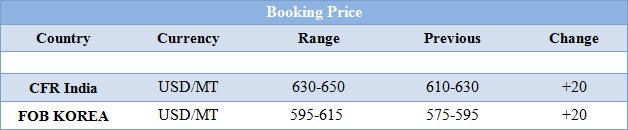

- CFR India prices were evaluated at USD 640/MT, increased by USD 20/MT in compare to last week’s closing values. CFR China price of toluene were assessed at the level of USD 630/MT.

- FOB Korea prices were evaluated at USD 605/MT, improved by USD 20/MT in compare to previous week.

- CFR south East Asia price were evaluated at USD 620/MT. Benzene FOB Korea prices remained firm for this week. FOB Korea values were assessed around USD 560/MT. On other side CFR China prices for Benzene were assessed USD 600/MT for this week.

- The market has been waiting for budget 2019 which was appreciated and has been given thumbs up all the sectors.

- There has been rise in crude values with positive talks in international market. The prices rise has been in particular due to cut in the supply to the US from Saudi Arabia.

- The price rise came after a report from the U.S. Energy Information Administration (EIA) on Wednesday showed a drop in Saudi crude supply to the United States.

- Crude oil prices were stronger after signs emerged that OPEC cuts are impacting trade. EIA's weekly report showed that U.S. imports from Saudi Arabia fell by more than half from the previous week to 442,000 barrels per day (bpd).

- The trade talks between US and China in coming days with positive hopes and substantial rise in talks. Meanwhile US sanctions imposed on Venezuela firm with many stocks stuck at ports is likely to accelerate supply drop in oil. Much Venezuelan crude oil is rated as heavy and requires the light petroleum naphtha, much of it supplied from the United States, for dilution before export to refineries.

$ 1 = Rs. 71.25

Import Custom Ex. Rate USD/ INR: 72.10

Export Custom Ex. Rate USD/ INR: 70.40