Styrene Monomer Weekly Report 3 May 2019

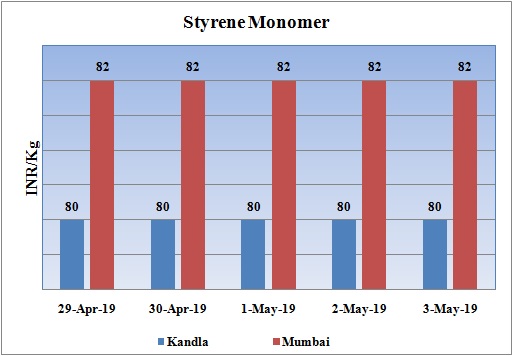

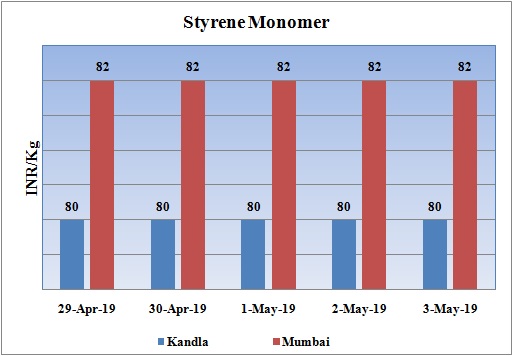

Weekly Price Trend: 29-04-2019 to 03-05-2019

- If we take a quick look at the above given weekly prices, it can be observed that for the current week prices of Styrene Monomer has remained vulnerable and has been consistently increasing on back of rise in crude values.

- On Friday domestic values were assessed around Rs.80/Kg for bulk quantity at Kandla and Rs.82/kg for Mumbai ports of India reduced by Rs.2/Kg for bulk quantity.

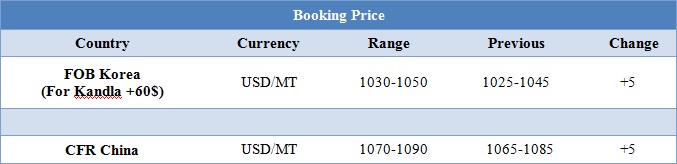

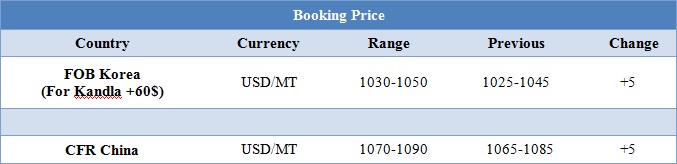

Booking Price

INDIA& INTERNATIONAL

- The domestic prices of Styrene were assessed at the level of Rs.80/Kg for Kandla and Rs 82/kg Mumbai ports. Domestic prices has reduced by Rs./Kg for bulk quantity for both the ports.

- On other side, FOB Korea values for Styrene were assessed around USD 1030-1050/MT, increased by USD 5/MT in this one week. On other side CFR China prices also increased by USD 5/MT for this week and were assessed at the levels of USD 1080/MT for this week. South East Asia prices of SM were evaluated at USD 1060/MT.

- Benzene FOB Korea prices has witnessed decline in international prices. Values were assessed at the level of USD 625/MT reduced by USD 25/MT in one week. On other side CFR China prices were assessed around USD 625/MT for this week.

- The election period going in the country has been major factor affecting the sentiments for Indian economy. Traders are in mood to know first about the government to take lead and then make any fresh position in the market.

- The chaos in Venezuela and plunge in the oil production is matter of great concern. The country has lost its stability and has been completely bankrupt. This in turn has led to decline in oil production. US has been forcing rest of the nations to corner Venezuela and stop taking any kind of fuel.

- Similarly with Iran the sanctions have been completely imposed with no mare waiver options. To this situation the supply has been curtailed from two major oil producing countries. But on contrary oil prices has lowered down due to ever increasing oil inventories in USD.

- Crude prices have lowered for this week. On Thursday day, closing crude values have decreased. WTI on NYME closed at $61.81/bbl. Prices have decreased by 1.79/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $1.43/bbl in compare to last closing price and was assessed around $70.75/bbl.

PLANT NEWS

SM unit shut down by Shandong Huaxing

- Shandong Huaxing Petrochemical has shut down its SM unit for maintenance turnaround. The unit has been shutdown as per annual maintenance schedule. It is likely to remain off-stream for 40 days and is expected to restart its production by the first week of June 2019.

- Unit is based at Shandong in China and has the production capacity of 80,000 tonnes/year.

$1 = Rs. 69.21

Import Custom Ex. Rate USD/ INR: 70.45

Export Custom Ex. Rate USD/ INR: 68.80