Phenol Weekly Report 8 Feb 2019

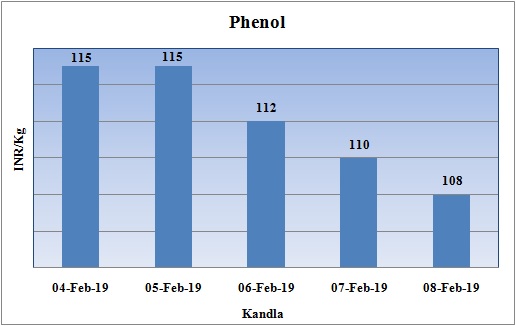

Weekly Price Trend: 04-02-2019 to 08-02-2019

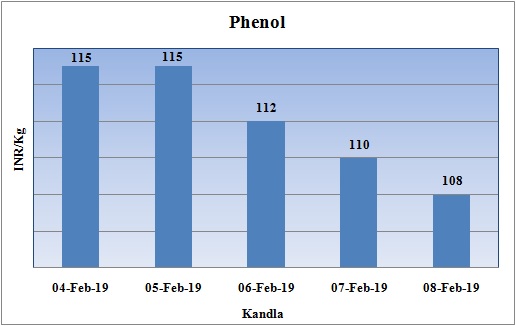

- The above given graph focuses on the Phenol price trend for the current week.

- If we take a quick look at the above given weekly price trend it can be observed that this week domestic prices reduced significantly fort this week.

- By end of the week prices were assessed at the level of Rs. 108/Kg for bulk quantity. Initially prices increased heavily and reached to the level of Rs.115/Kg but as week proceeded further there was decline in domestic prices.

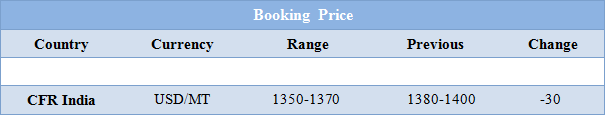

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic phenol market prices were assessed around Rs.108/Kg for bulk quantity. Prices increased by Rs.11/Kg for this week.

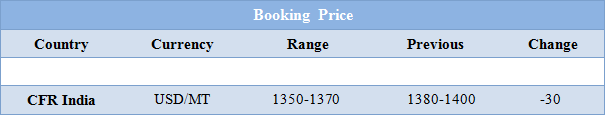

- CFR India prices for this week were assessed in the range of USD 1380-1400/MTS, increased by USD 40/MTS for this week.

- Benzene FOB Korea prices remained firm for this week. FOB Korea values increased by USD 25/MT and were assessed around USD 600/MT. On other side CFR China prices were assessed around USD 605/MT for this week.

- Moreover the ongoing Lunar vacation in China has also slowed down the trade and trading in international market.

- International prices for Methanol for this week were assessed around USD 305/MT increased by USD 15/MT for this week. Methanol values remained flat in China market.

- Benchmark Brent oil inched up on Friday but was heading for a weekly loss, pulled down by worries about a global economic slowdown, although OPEC-led supply cuts and U.S. sanctions against Venezuela provided crude with some support.

- U.S. President Donald Trump said on Thursday that he did not plan to meet Chinese President Xi Jinping before a March 1 deadline set by the two countries to strike a trade deal.

- Adding to demand concerns, the European Commission sharply cut its forecasts for euro zone economic growth due to global trade tensions and an array of domestic challenges.

- Supply cuts led by the Organization of the Petroleum Exporting Countries lent support. OPEC kingpin Saudi Arabia reduced its output in January by about 400,000 barrels per day (bpd) to 10.24 million bpd, OPEC sources said.

- Another risk to supply comes from Venezuela after the implementation of U.S. sanctions against the OPEC member's petroleum industry in late January. Analysts expect this move to knock out 300,000-500,000 bpd of exports.

PLANT NEWS

Release of Phenol ADD probe findings has been delayed by China

- In March 2018, Chinese government initiated probe on Anti dumping duty investigation on Phenol imports from five origins which include US, EU, South Korea, Japan and Thailand. The initial probe lasts for six months but it has been delayed by one year now. “This is the longest ADD investigation in quite a while. Under normal circumstances, the final results would have been announced in one year,

- Chinese authorities may be opting to wait until after the 90-day trade war truce with the US lapses on 1 March, before taking any further action.

- Chinese buyers had lost interest in US-origin phenol following imposition of a 10% import duty in late August 2018. US was a major exporter of the material to China, from which the northeast Asian country sourced about a third of its phenol imports in 2016.

- US-origin phenol bound for China was imposed with a 10% import duty in late August last year, when the second volley of shots were fired in the trade war between the two economic giants.

$1 = Rs. 71.18

Import Custom Ex. Rate USD/ INR: 72.65

Export Custom Ex. Rate USD/ INR: 70.95