Phenol Weekly Report 22 Feb 2019

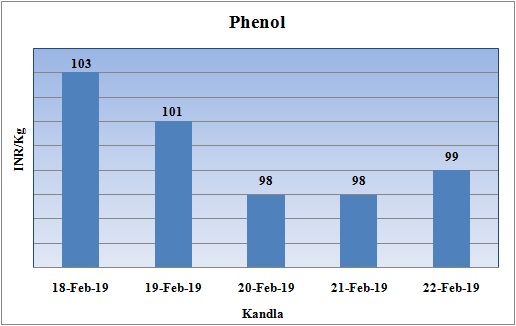

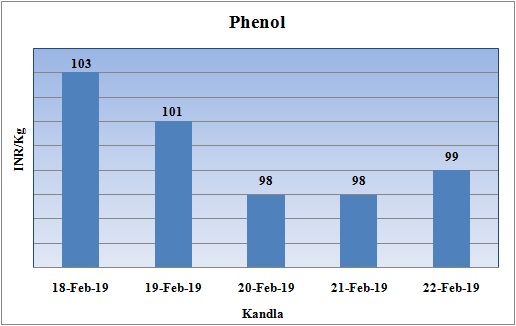

Weekly Price Trend: 18-02-2019 to 22-02-2019

- The above given graph focuses on the Phenol price trend for the current week.

- If we take a quick look at the above given weekly price trend remained highly vulnerable and has been turbulent for this week.

- By end of the week prices were assessed at the level of Rs. 99/Kg for bulk quantity. Prices have reduced significantly in domestic market. The fall in values is on back of plenty of supply in the domestic market.

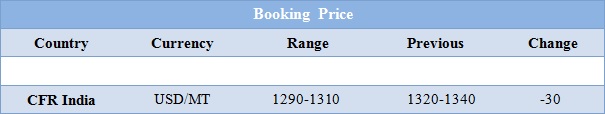

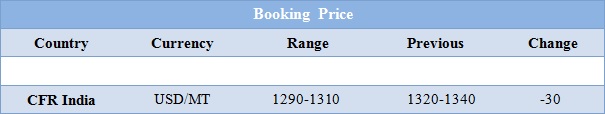

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic phenol market prices were assessed around Rs.99/Kg for bulk quantity.

- CFR India prices for this week were assessed in the range of USD 1290-1310/MTS, reduced by USD 30/MTS for this week.

- Benzene the major source for Phenol has increased on contrary to Phenol in international market. Benzene FOB Korea prices remained stable to firm for this week. FOB Korea values were assessed around USD 630/MT, increased by USD 15/MT for this week.

- The recent terror attack on Indian military will have an adverse impact on Indian trade relation with neighboring nation. Moreover such heinous attacks affect the economy of the country as well.

- US crude has hit a new high in production this week. Prices on back of this production has hit to bottom despite of OPEC trying to withhold the production and tighten global markets.

- International Brent crude futures were at $66.87 per barrel at 0326 GMT, down 20 cents, or 0.3 percent, from their last close. U.S. West Texas Intermediate (WTI) crude oil futures were at $56.84 per barrel, down 12 cents, or 0.2 percent, from their last settlement.

- U.S. crude output has soared by almost 2.5 million bpd since the start of 2018, and by a whopping 5 million bpd since 2013. America is the only country to ever reach 12 million bpd of production.

- OPEC and some non-affiliated producers such as Russia agreed late last year to cut output by 1.2 million bpd to prevent a large supply overhang from growing. Another recent price driver has been U.S. sanctions against oil exporters Iran and Venezuela.

$1 = Rs. 71.14

Import Custom Ex. Rate USD/ INR: 72.00

Export Custom Ex. Rate USD/ INR: 70.30