Phenol Weekly Report 2 August 2019

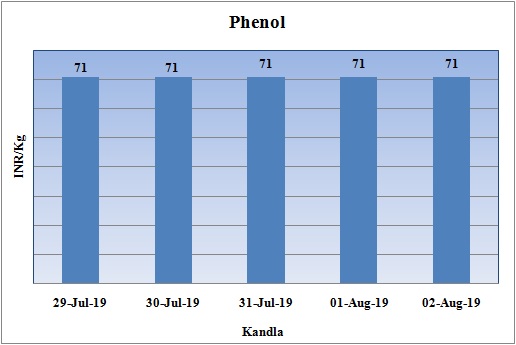

Weekly Price Trend: 29-07-2019 to 02-08-2019

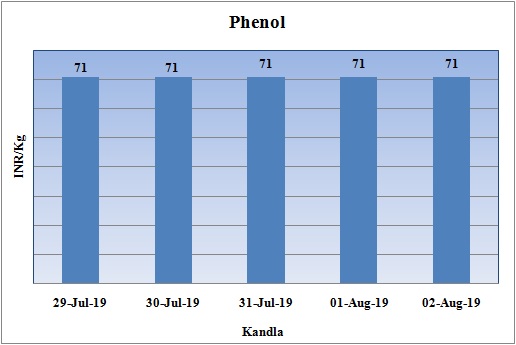

- The above given graph focuses on the Phenol price trend for the current week.

- If we take a quick look at the above given weekly price remained stable throughout this week. By end of the week prices were assessed at the level of Rs. 71/Kg for bulk quantity reduced by Rs2/kg for this week.

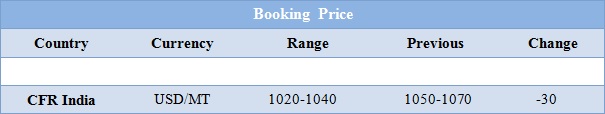

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic phenol market prices were assessed around Rs.71/Kg for bulk quantity. Prices reduced slightly by Rs.2/Kg for this week and were assessed at the level of Rs.71/Kg for bulk quantity.

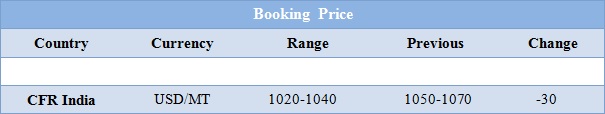

- CFR India prices for this week were assessed in the range of USD 1020-1040/MTS, reduced by USD 30/MTS for this week in compare to last week’s closing values.

- Benzene the major source for aromatic products has also improved for this week. FOB Korea values for Benzene were assessed around USD 663/MT, increased by USD 8/MT for this week, while CFR China prices also increased and were assessed at the level of USD 656/MT for this week.

- There has been significant slowdown in Phenol prices in Asia. The demand has reached to its lowest levels in last two years in one of the price markets of China. The continuous weakening of Bisphenol A and polycarbonate sectors.

- Demand has further declined with imposition of Anti dumping duty tariffs by China on imports from the US, Europe, South Korea, Japan and Thailand.

- The ongoing trade tariff war between China and US is other major factor affecting the imports of Phenol.

- China has slapped a 10% duty on US phenol in August in the second round of the tit-for-tat tariff war between the two economic giants.

- On top of the import duty, China has imposed ADD rates of as much as 129.6% on US phenol. Due to these declining values major Phenol units has either shutdown their units for maintenance or curtailed their production.

- South Korean manufacturer Kumho, P&B Chemicals has shut down their unit 2 and other units are operating at reduced rates. Mitsui Phenol Singapore has also curtailed their production rate. Mitsui Chemicals of Japan has shut down their unit itself.

- Experts believe the revival in price will take place only in August with many units to restart their units.

$1 = Rs. 69.59

Import Custom Ex. Rate USD/ INR: 70.00

Export Custom Ex. Rate USD/ INR: 68.30