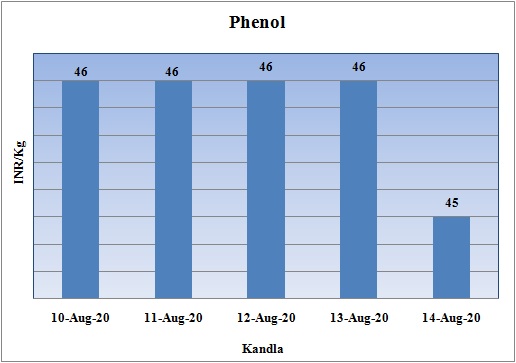

Phenol Weekly Report 14 August 2020

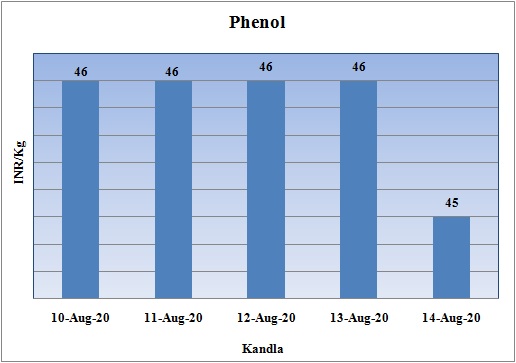

Weekly Price Trend: 10-08-2020 to 14-08-2020

- The above given graph focuses on the Phenol price trend for the current week.

- If we take a quick look at the above given week, prices remained stable for most of the week and reduced slightly by end of the week.

- Prices were assessed at the level of Rs.45/Kg for bulk quantity, declined by Rs.1/Kg for this week.

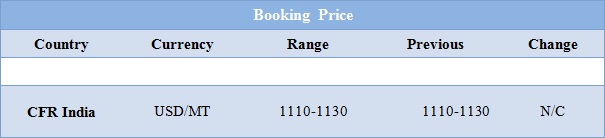

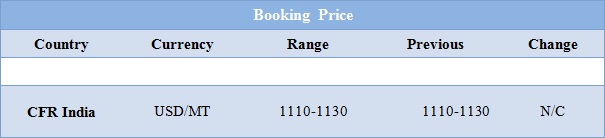

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic phenol market prices were assessed around Rs.45/Kg for bulk quantity. Prices reduced by Rs.1/Kg for this week.

- CFR India prices for this week were assessed in the range of USD 1110-1130/MTS for this week. Prices remained unchanged for this week.

- FOB Korea values for Benzene were assessed around USD 440/MT for this week. There has been a rise of USD 10/MT in Benzene values. CFR China prices were assessed at the level of USD 450/MT for this week.

- There has been decline in Benzene FOB Korea prices while its has increased in China market.

- There has been heavy rains in the western part of India specifically Mumbai which has halted all the port as well as other operations.

- There has been mixed trend in petrochemical market. Prices for the specific category of chemicals have been declining with slowdown in demand. Petrochemical segment has been struggling owing oversupply. There has been steep decline in consumption as most of the economies in Asian subcontinent are passing through major recession phase.

- To add to their woes the downstream industry continues to operate at reduced rates due to poor demand and supply factors. Inventories are piling up in domestic industry which is an alarming signal for everyone.

- Most major countries in southeast Asia posted sharp economic contractions in the second quarter, while the number of infections in countries such as Indonesia, the Philippines and India continue to spike.

- Producers are not lowering offers substantially to maintain some margins due to a relatively stable feedstock acetic acid market.

- China, which was the original epicentre of the outbreak, new cases are still being reported daily.

- India stands fourth in the tally of highest number of Covid infections

$1 = Rs. 74.88

Import Custom Ex. Rate USD/ INR: 75.75

Export Custom Ex. Rate USD/ INR: 74.00