Phenol Weekly Report 07 April 2018

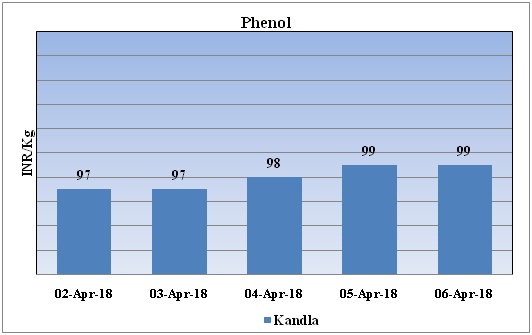

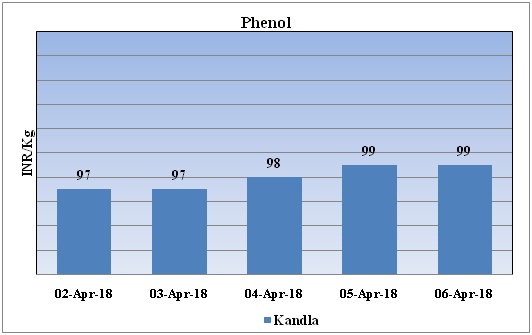

Weekly Price Trend: 02-04-2018 to 06-04-2018

- The above given graph focuses on the Phenol price trend for the current week.

- If we take a quick look at the above given weekly price trend it can be observed that this week domestic market prices of Phenol have plunged little and at the end of the week prices were assessed at the level of Rs. 99/Kg for bulk quantity.

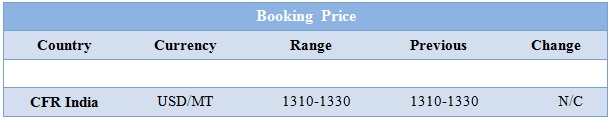

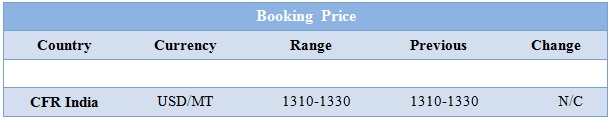

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic phenol market prices were assessed around Rs.99/Kg for bulk quantity. Prices have increased.

- CFR India prices for this week were assessed in the range of USD 1310-1330/MTS, prices have remained firm in compared to last assessed values.

- With imposition of ADD by China on imports of Phenol has led to slowdown in imports of Phenol. The investigation initiated by the government will be completed only next year in 2019 and may extend for next six months. Chinese importers feel that if the ADD is imposed, this will force them to consider import alternative sources of non-ADD deep-sea supply. N current scenario, Chinese importers are purchasing deep-sea cargoes from the US, the Middle East, and the EU as they are more competitively- priced compared with Asia-origin shipments. According tp Chinese importers, they are possibly looking towards the Middle East as compared to the US and the EU as a source of deep-sea phenol. The lack of ADD on the Middle East cargoes is likely to make prices competitive.

- This week crude oil prices have remained volatile. On Thursday oil prices increased from gains in U.S. equities markets as trade tensions between China and the United States eased, but the advance was limited by strength in the dollar.

- On Thursday, closing crude values have increased. WTI on NYME closed at $63.54/bbl; prices have decreased by $0.17/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.31/bbl in compared to last trading and was assessed around $68.33/bbl.

- As per report, U.S. crude production hit a new high, but that was not enough to change the overall bullishness. OPEC and its allies are collectively curbing 1.8 million barrels per day of crude output to help eliminate a global oil glut. The cuts run until the end of 2018 but Saudi Arabia has said they could be extended in some form into 2019.

- This week feedstock benzene prices also have increased in Asian market.

- FOB Korea and CFR China prices of Benzene were evaluated at USD 835/mt and USD 835mt respectively.

$1 = Rs. 64.96

Import Custom Ex. Rate USD/ INR: 65.90

Export Custom Ex. Rate USD/ INR: 64.20