Mixed Xylene Weekly Report 17 June 2017

Weekly Price Trend: 05-06-2017 to 09-06-2017

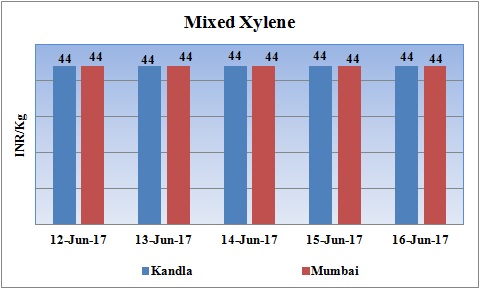

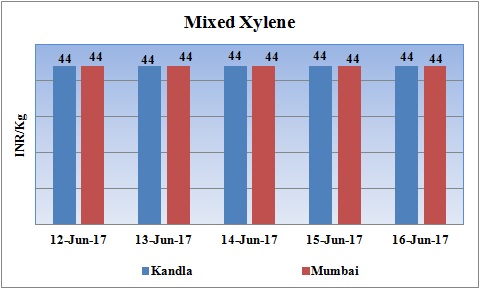

- The above given graph focuses on the Mixed Xylene price trend for the current week.

- Domestic prices ofMixed Xylene decreased slightly for this week. Prices were assessed at the level of Rs.44/Kg for Kandla port and Rs.44/Kg for Mumbai port.

Booking Scenario

INDIA

- Mixed Xylene prices were assessed around Rs.44/Kg at Kandla port andRs.44/Kg for Mumbai port.

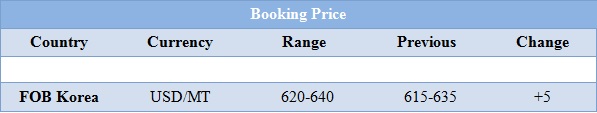

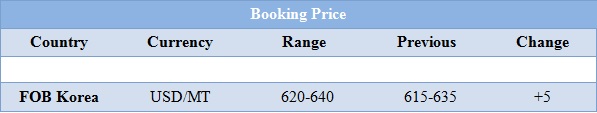

- International prices of Isomer grade Mixed Xylene increased slightly for this week. Prices were assessed in the range of USD 620-640/MTS, with an increase of USD 5/MTS in compare to last week’s closing values.

- CFR SE Asia prices were assessed in the range of USD 650-670/MT, increased by USD 5/MTS in compare to last week’s assessed values.

- This week there has been mixed trend followed in the petrochemical market. To be specific with Indian market the confusion and chaos related to implementation of GST has weakened the market sentiments. The Indian government is in full mood to implement this GST from 1 July. Market participants are all in baffled state as nothing has been clearly stated and clarified. As per last announcement by the government an 18% GST rate will apply to chemicals and polymers. As Indian government defines “GST is a single tax on the supply of goods and services, right from the manufacturer to the consumer… It will ensure that indirect tax rates and structures are common across the country, thereby increasing certainty and ease of doing business,”. In China the sentiment too remained perplexed with implementation of consumer tax.

- This week oil prices followed mixed trend and on Thursday oil market closed on reducing note. Yesterday, the prices market reduced by more than 4% in a day. This week the global oil market have remained flooded with surplus oil, rising U.S. crude production and weak domestic gasoline demand kept pressure on prices.

- As per report, the outlook for the energy market will remain bearish. OPEC’s agreement with non-OPEC members “remains brittle as none of those participating are happy about the arrangement. In the U.S., the trend of rising production remains strong while gasoline demand has been soft so oil production is expected to continue to rise steadily this summer. High exports and production from other countries, including Russia and the United States, are also contributing to the ongoing glut.

- On Thursday, closing crude values have decreased.WTI on NYME closed at $44.46/bbl, prices have decreased by $0.27/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.08/bbl in compared to last trading and was assessed around $46.92/bbl.

$1 = Rs. 64.42

Import Custom Ex. Rate USD/ INR: 65.15

Export Custom Ex. Rate USD/ INR: 63.50