Mixed Xylene Weekly Report 04 March 2017

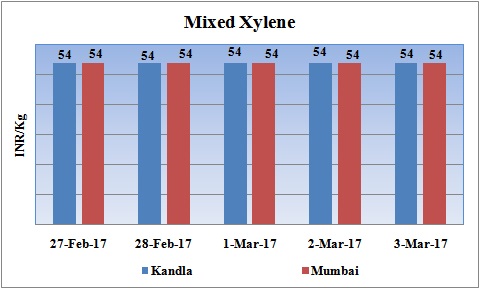

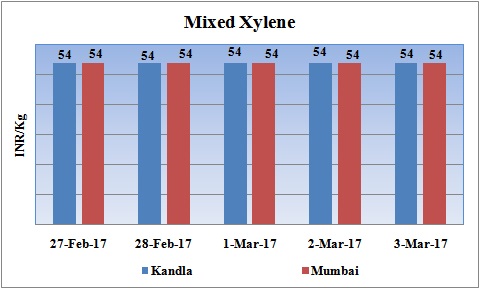

Weekly Price Trend: 27-02-2017 to 03-03-2017

- The above given graph focuses on the Mixed Xylene price trend for the current week.

- Domestic prices ofMixed Xylene increased slightly for this week. Prices were assessed at the level of Rs.54/Kg for Kandla port and for Mumbai port.

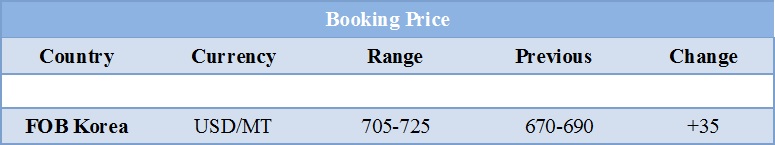

Booking Scenario

INDIA

- Mixed Xylene prices were assessed around Rs.54/Kg at Kandla port and for Mumbai port.

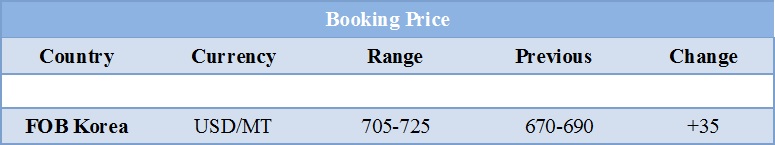

- International prices of Isomer grade Mixed Xylene increased significantly for this week. Prices were assessed in the range of USD 705-725/MTS with an increase of USD 35/MTS in compare to last week’s closing values.

- CFR SE Asia prices were assessed in the range of USD 725-745/MT.

- Leading petrochemical manufacturer of petrochemicals Idemitsu Kosan and JX Nippon Oil Energy has re-nominated their Asian Contract Prices for the month of March.

- Idemitsu Kosan lowered its price for Para Xylene by USD 40/MTS and new price has been USD 940/MTS. X Nippon Oil & Energy nominated its March ACP at $980/mt CFR, while South Korea's SK Global Chemical and S-Oil nominated at $970/mt and $960/mt CFR respectively.

ExxonMobil was the last producer to nominate its March Para Xylene Asia CP, at $970/mt CFR Monday. Although the nominations are higher than the February settlement which was around USD 900/MT.

- Petro China of Dalian Petrochemical is planning to shut its aromatic unit for maintenance turnaround. The unit is likely to undergo maintenance on 17th March and is expected to remain off-stream for around 45 days. The unit is based at Dalian in China and has the production capacity of 2,90,000 mt/year of benzene, 3,52,000 mt/year of toluene and 4,40,000 mt/year of mixed xylenes.

- Oil prices remained variable throughout his week. Oil prices headed lower on Thursday to log their lowest finish in last three weeks, as U.S. government data showed that domestic crude inventories hit a record production and production edged higher last week.

- As per market sources, the high crude stockpile levels in the U.S. is the one of the major reasons behind oil’s recent inability.

- On Friday, oil prices rose as the United States imposed sanctions on some Iranian individuals and entities.

- The increasing U.S. crude output in recent months has largely offset the continuing production cuts by the OPEC and Russia. The two counterforce are keeping prices in a slim range, said by analysts.

- Market predictors are anticipating that the respite to continue for more weeks with the next major price mover likely to be OPEC’s meeting at the end of May in which members will decide whether to extend the cuts beyond the initial six-month period.

- On Thursday, closing crude values have decreased.WTI on NYME closed at $52.61/bbl, prices have decreased by $1.22/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $1.28/bbl in compared to last trading and was assessed around $55.08/bbl.

$1 = Rs. 66.81

Import Custom Ex. Rate USD/ INR: 67.65

Export Custom Ex. Rate USD/ INR: 66.00