Methanol Weekly Report 9 August 2019

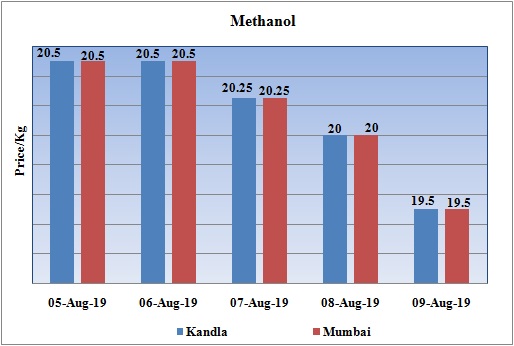

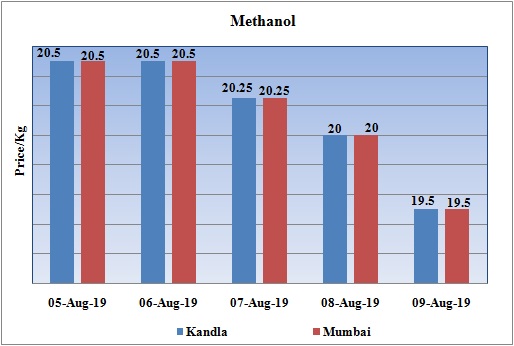

Weekly Price Trend: 05-08-2019 to 09-08-2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained vulnerable throughout this week. Domestic prices were assessed at the level of Rs.19.5/Kg for bulk quantity by end of the week.

- By the end of the week prices were assessed around Rs 19.5/Kg for Kandla and Mumbai ports.

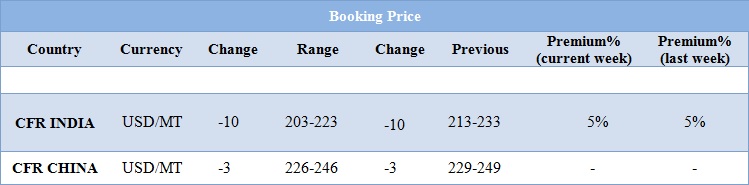

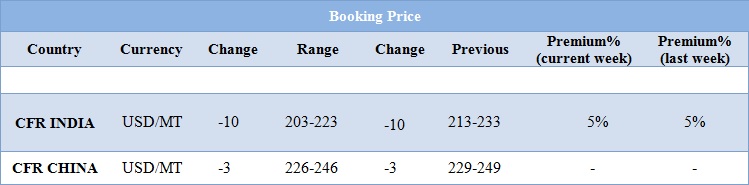

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol remained vulnerable there was a constant variation in the values. Prices in the domestic market reduced significantly for this week and were assessed at the level of Rs.19.5/Kg for bulk quantity.

- CFR India prices were assessed around USD 213/MTS, reduced by USD 10/MT for this week. With ongoing monsoon season at its peak there has been significant decline in demand for Methanol. There has been slowdown in demand from domestic market due to monsoon across the nation.

- CFR China prices were assessed around USD 226-246/MT, reduced by USD 3/MT for this week.

- There has been major slump in Methanol prices in China market. The crucial factors have been demand and supply fundamentals. With higher cost of production and low supply the manufacturers are in steady state.

- Domestic manufacturers in China are reluctant to reduce price further, but the loss is not unacceptable and not large enough to force plants to shut down. On one side the cost has been affecting market but on other side product inventory is still high, adverse to the market.

- Many MTO units are likely to start their production. Jiutai Energy started their production this week while Shenhua Yulin is expected to restart its 600kt/yr MTO plant in the first half of Aug after a 15-day maintenance. Sailboat plans to shut is 833kt/yr MTO plant on Jul 31 for 15 days, Yangmei Hengtong also has maintenance schedule in near term, Yan’an Energy and Chemical’s 600kt/yr MTO plant is expected to start maintenance in the end of Aug, Shenhua Xinjiang’s 600kt/yr plant is anticipated to shut in end-Aug for maintenance, and also Shenhua Baotou’s 600kt/yr MTO plant may start maintenance in mid-Sep. The combined capacity of MTO plants with upcoming shutdown schedules is much larger than of restarted ones.

PLANT NEWS

Shandong Rongxin to resume its Methanol production

- China based Shandong Rongxin Coal Chemical Company to restart its Methanol production plant. Earlier the unit was shut down for annual maintenance.

- Unit is based at Shandong in China and has the production capacity of Methanol around 2,50,000 tonnes/year.

MTO unit shutdown by Jiangsu Sailboat Petrochemical

- Jiangsu Sailboat Petrochemical has shutdown its Methanol-to-Olefins unit for annual maintenance in the last week of July due to some technical issues. According to sources the unit is likely to resume its production in the mid of August 2019.

- Unit is based at Lianyugang in Jiangsu province of China and has the production capacity of Ethylene around 3,60,000 mt/year and Propylene capacity of 4,70,000 mt/year.

MTO unit shutdown by Shenhua Coal to Liquid and Chemical Co

- Shenhua Coal to Liquid and Chemical Co has shutdown it’s Methanol-to-Olefins in the last week of July 2019. The unit is likely to remain off-stream for one more week and may resume its production in the next week.

- Unit is based at Yulin in Shaanxi in China and has the production capacity of ethylene capacity of 300,000 mt/year and propylene capacity of 300,000 mt/year.

$1 = Rs. 70.74

Import Custom Ex. Rate USD/ INR: 70.00

Export Custom Ex. Rate USD/ INR: 68.30