Methanol Weekly Report 6 March 2020

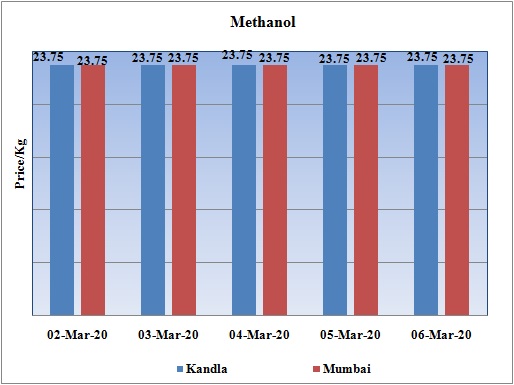

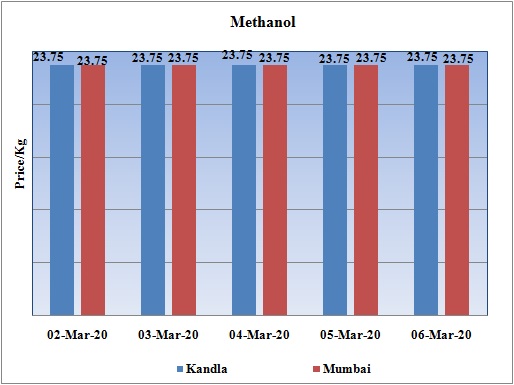

Weekly Price Trend: 02-03-2020 to 06-03--2020

- The above graph focuses on the Methanol price trend for the current week. Prices have remained stable for most of the week. Domestic prices were assessed at the level of Rs.23.75/Kg for this week.

- By the end of the week prices were assessed around Rs 23.75/Kg for Kandla and Mumbai ports.

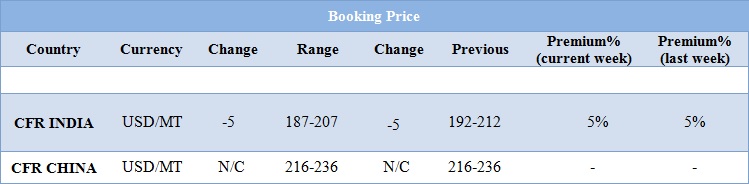

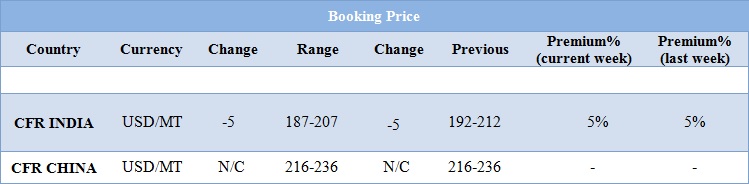

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have remained vulnerable and were assessed around Rs.23.75/kg for this week for bulk quantity.

- CFR India prices were assessed around USD 197/MTS, reduced by USD 5/MTS for this week.

- China market also remained unchanged for this week. CFR China prices were assessed around USD 226/MT for this week.

- China is one of the leading importers of Methanol from Iran. With rise in number of cases of Coronavairus infection, Chinese authorities have decided to have strict check for the imports in order to curtain the epidemic.

- At present Iran has the highest death toll of the coronavirus outside China at more than 60, with about 1,500 cases of infection. Countries like Pakistan, Iraq, Turkey, Armenia and Afghanistan have already announced closures of their land borders with Iran. Turkey, Oman, Bahrain and Kuwait have also suspended the flights to and from the country.

- Right now, Iran’s methanol supply to China has not been affected, with Iranian plants currently in the process of recovering production since late February as shortage of feedstock natural gas has eased with the warmer weather.

- Saudi Arabia based Methanol Chemical Companies (Chemanol) has received an approval for the expansion of its existing capacity. The Ministry of Energy has approved for extra feedstock allocation to expand its methanol plant by 100,000 metric tons/year. The company’s current methanol capacity is 230,000 metric tons/year. Chemanol’s downstream portfolio includes formaldehyde and derivatives.

- The extra methanol will be used to feed new plants, namely dimethyl disulfide and methyl diethanolamine, which will be the first such plants in Saudi Arabia. The company expects the new units to be operational by 2024. The projects form part of Chemanol’s diversification strategy in line with Saudi Vision 2030.

$1 = Rs. 73.67

Import Custom Ex. Rate USD/ INR: 74.25

Export Custom Ex. Rate USD/ INR: 72.55