Methanol Weekly Report 30 Nov 2018

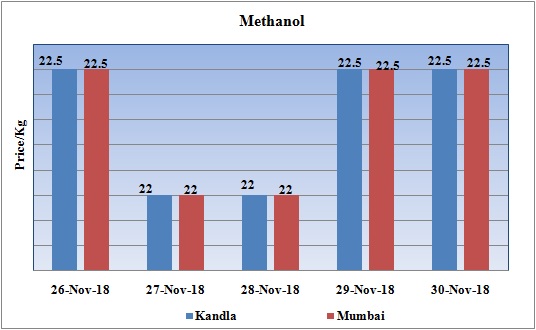

Weekly Price Trend: 19-11-2018 to 30-11-2018

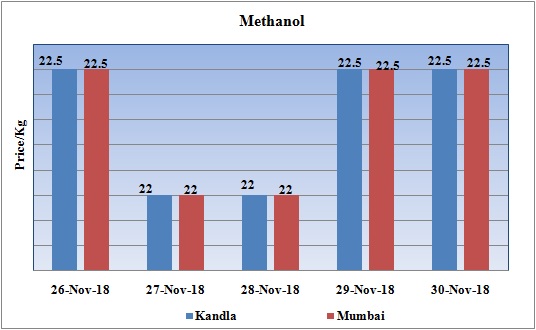

- The above graph focuses on the Methanol price trend for the current week. Prices remained highly vulnerable for this week.

- By the end of the week prices were assessed around Rs 22.5/Kg for Kandla and Mumbai ports.

- Domestic prices have reduced by Rs.2.25/Kg for bulk quantity in the span of one week. Decline has been due to oversupply of chemical in the domestic market.

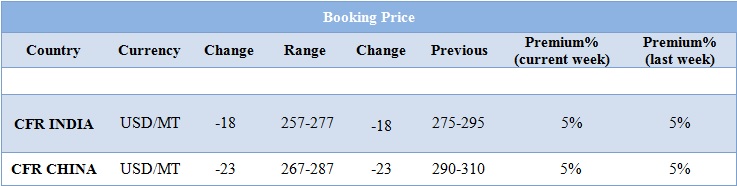

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol prices declined significantly on back of oversupply of chemical in the international market. By end of the week prices were assessed around Rs.22.5/Kg for Kandla and Mumbai port for bulk quantity.

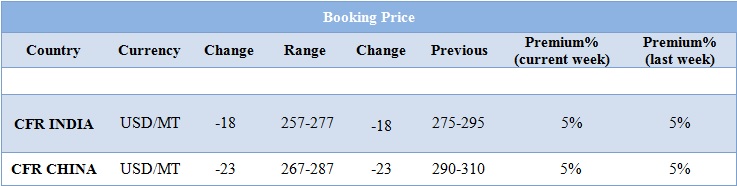

- CFR India prices were assessed around USD 267/MTS, reduced by USD 18/MT for this week. On other side CFR China prices were assessed around USD 277/MT reduced by USD 23/MT for this week.

- Crude market has declined by more than 30% in the month of November. Prices have remained vulnerable throughout this week.

- In last one month, crude prices have reached to its lowest level with WTI closed at $54.43 which was earlier $75 per barrel in the first week of October. Decline in crude values has also affected the Indian currency against dollar. Rupee settled at Ra.70.6 reduced by Rs.5 against dollar.

- Decline in crude values has affected petrochemical market heavily. Before Iran sanctions the market was on great high with fear of decline in crude supply. Crude supply from Saudi was also reduced internationally to built up the crude values. As a result most of the crude from Iran was dumped into the China market.

- Crude has declined by more than 20% in last three weeks. Oil prices closed at a new yearly low Wednesday but edged up Thursday to $51.45/bbl in morning trading. Since hitting the yearly high in early October, benchmark West Texas Intermediate has dropped by 32%.

- Majormanufacturer Methanex has also cut down its rate for Asian and North America market.

- Asian contract prices has been reduced by USD 80/MT and were posted at USD 430/MT. Prices posted for the region of North America are USD 469/MT reduced by USD 50/MT for this month.

$1 = Rs. 69.65

Import Custom Ex. Rate USD/ INR: 72.95

Export Custom Ex. Rate USD/ INR: 71.25