Methanol Weekly Report 27 Oct 2018

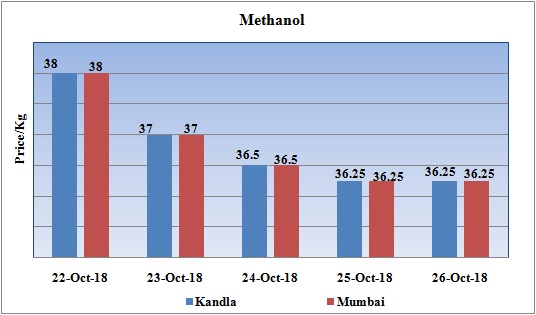

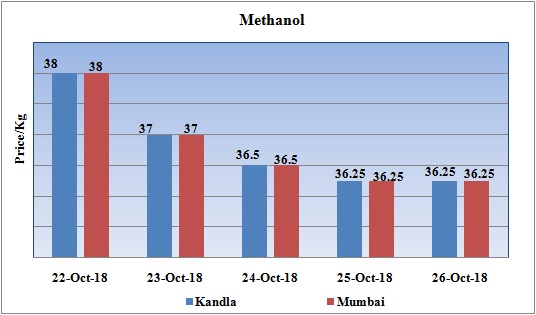

Weekly Price Trend: 22-10-2018 to 26-10-2018

- The above graph focuses on the Methanol price trend for the current week. Prices remained highly vulnerable for this week.

- By the end of the week prices were assessed around Rs 36.25/Kg for Kandla and Mumbai ports.

- Domestic prices have reduced by Rs.1.75/Kg for bulk quantity in the span of one week. Decline has been due to oversupply of chemical in the domestic market.

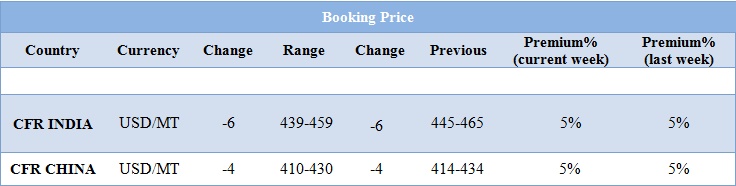

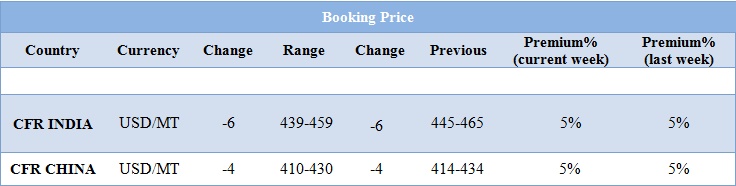

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol prices declined significantly on back of oversupply of chemical in the international market. By end of the week prices were assessed around Rs.36.25/Kg for Kandla and Mumbai port for bulk quantity.

- CFR India prices were assessed around USD 449/MTS, reduced by USD 6/MT for this week. On other side CFR China prices were assessed around USD 420/MT reduced by USD 4/MT for this week.

- There has been oversupply in domestic market along with lull buying sentiments due to upcoming Diwali festival. Prices are likely to remain subdued for the coming week as well.

- Oil prices reduced on Friday and were heading for a third weekly loss, pulled down as Saudi Arabia's OPEC governor said the market may become oversupplied soon and after a slump in global equities clouded the outlook for demand.

- "Bearish sentiment could force a re-test of support in the low $70.0 per barrel range.

- The market may shift towards an oversupply situation as evidenced by rising inventories over the past few weeks.

- U.S. crude oil stockpiles rose last week for the fifth consecutive week, while gasoline and distillate inventories fell, the Energy Information Administration said this week.

- Financial markets have been hit hard by a range of worries, including the U.S.-China trade war, a rout in emerging market currencies, rising borrowing costs and bond yields, and economic concerns in Italy.

- Washington is putting pressure on governments around the world to stop importing oil from Iran.

- Most, including its biggest customer China, are falling in line, and Iran has turned to storing its unsold oil on its tanker fleet in the hope that it can sell the crude off quickly once the sanctions are lifted again.

- Prices in the US market have also increased unprecedentedly and are on continuous surge. Experts believe that production outage in Trinidad and Tobago could be exerting the upward pressure.

- There has been significant decline in crude prices in last two weeks. Prices plunged by more than 11 % in last two weeks. Oil prices rose to nearly four-year highs at the start of October as there has been depletion in crude supply sue to US sanctions on Iran.

- Rising U.S. crude stockpiles, forecasts for slower-than-expected demand growth and a sell-off in stock markets have weighed on crude futures.

- The supply of oil held in U.S. storage tanks has risen sharply over the last four weeks. U.S. crude stockpiles are up by 22.3 million barrels through last week. That's the biggest increase over that four-week period since 2015, when storage levels were rising toward all-time highs in a heavily oversupplied market.

- The market remains uncertain about the ability of producers such as Saudi Arabia and Russia to fill the gap left by the loss of roughly 1 million barrels a day of Iranian exports. Analysts say the market is deeply cynical that Riyadh would cut output and push oil prices higher to settle a political score.

PLANT NEWS

Methanex ramps up production at Chile IV plant for first time since 2007

Methanex expects to ramp output at its 800,000 mt/year Chile IV methanol plant in Cabo Negro, Chile, up to capacity over the next few weeks, CEO John Floren said Thursday.

"The intention is to run Chile I and IV to full rates as soon as possible. First, we will ramp up Chile IV, stabilize it, then slowly ramp up Chile I," Floren said in a third-quarter results call. The Chile IV plant has been idle since 2007. As the plant continues to ramp up, Methanex has begun to receive natural gas from Argentina for the first time in 11 years.

"We expect that our current gas agreements will allow for a two-plant operation in Chile during the southern hemisphere summer months and up to a maximum of 75% of a two-plant operation annually until mid-2020," the company said. The combined production capacity of the Chile I and IV facilities is currently 1.7 million mt/year.

The company's facility in Chile produced 112,000 mt in Q3, down 12.5% compared with the second quarter, but up 43.6% year on year.

$1 = Rs. 73.46

Import Custom Ex. Rate USD/ INR: 74.30

Export Custom Ex. Rate USD/ INR: 72.60