Methanol Weekly Report 25 September 2020

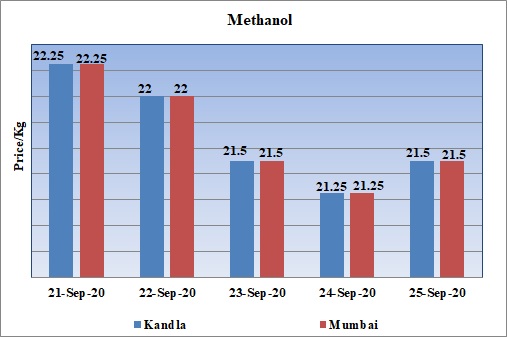

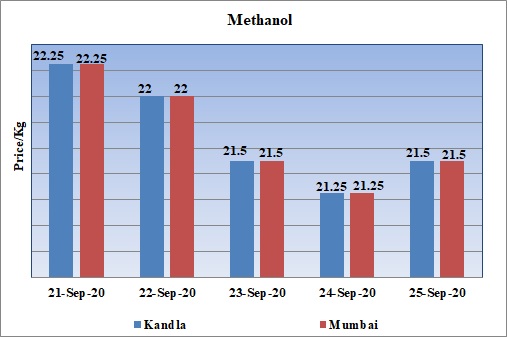

Weekly Price Trend: 21-09-2020 to 25-09-2020

- The above graph focuses on the Methanol price trend for the current week. Prices remained variable throughout this week. There has been rise and fall in values throughout this week.

- By the end of the week prices were assessed at the level of Rs.21.5/Kg for this week. There has been significant variation in domestic values.

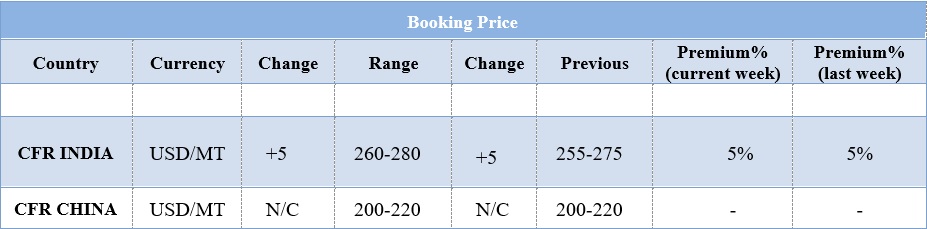

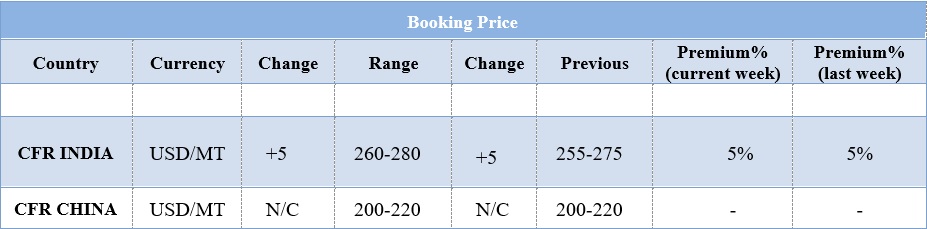

BOOKING SCENARIO

INDIA & INTERNATIONAL

- This week domestic market prices of Methanol remained volatile throughout this week.

- Prices for India were assessed around USD 270/MT, with an increase of USD 5/MT for this week. CFR China prices were assessed around USD 210/MT for this week.

- On other side CFR SEA prices were assessed in the range of USD 260/MT.

- The global market is feeling the heat of pandemic and exports across the nations has dropped significantly. Singapore the energy hub in the South Asian region has witnessed the decline in exports by 16.4%.

- To India’s woes the geopolitical tension with China has been hitting hard the country imports and has affected the further demand in the country.

- The global market is feeling the heat of pandemic and exports across the nations has dropped significantly. Singapore the energy hub in the South Asian region has witnessed the decline in exports by 16.4%.

- The global market is feeling the heat of pandemic and exports across the nations has dropped significantly. Singapore the energy hub in the South Asian region has witnessed the decline in exports by 16.4%.

- There has been decline in capacity utilization of Indian refineries. On an average the capacity utilization for all categories has declined to 76% which was earlier 83% in the month of August. The lowest reruns of refineries owing pandemic and lockdown imposed has led to shutdown and maintenance of refineries. The run rate was 104% in the year-ago period.

- Refineries like Indian Oil Corp's Paradip, Reliance's export-oriented unit, and Hindustan Petroleum Corp. Ltd's Vizag refinery carried out maintenance programs at a time when retail demand is low due to the COVID-19 impact.

- On Thursday closing, there was improvement in prices. WTI on NYME closed at $40.31/bbl. Prices improved by 0.38/bbl in compared to last closing prices. While Brent on Inter Continental Exchange has reduced by $0.41/bbl in compare to last closing price and was assessed around $41.94/bbl.

$1 = Rs. 73.61

Import Custom Ex. Rate USD/ INR: 74.60

Export Custom Ex. Rate USD/ INR: 72.90