Methanol Weekly Report 20 December 2019

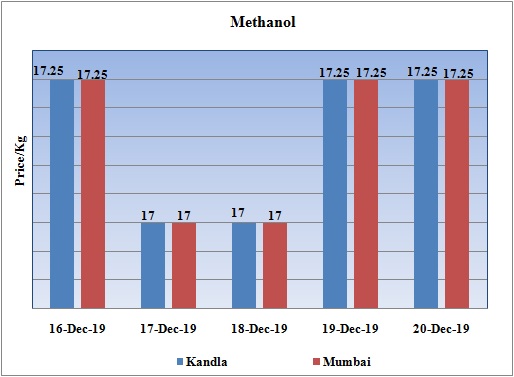

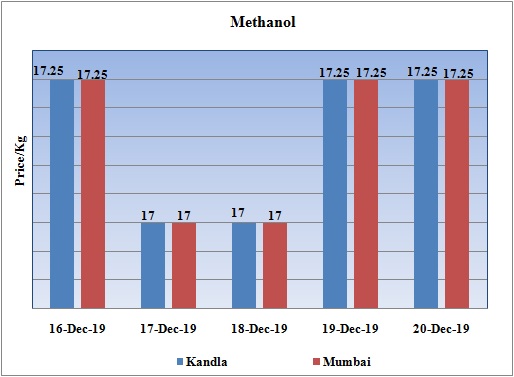

Weekly Price Trend: 16-12-2019 to 20-12--2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained vulnerable throughout this week. Domestic prices were assessed at the level of Rs.17.25/Kg for bulk quantity by end of the week.

- By the end of the week prices were assessed around Rs 17.25/Kg for Kandla and Mumbai ports.

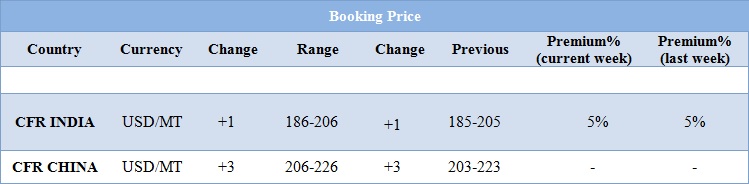

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have remained mixed throughout this week. There has been slight disruption in the demand sentiments. Prices in the domestic market were assessed at the level of Rs.17.25/Kg for bulk quantity.

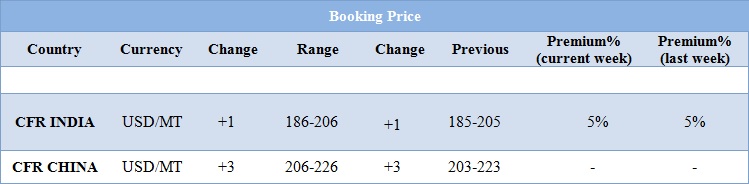

- CFR India prices were assessed around USD 196/MTS, a rise of USD 1/MT for this week.

- CFR China prices were assessed around USD 206-226/MT, improved by USD 3/MT for this week.

- With ongoing winter season in Iran and other major methanol manufacturing nations there will be shortage in the supply of the Methanol as majority of units prefer to undergo maintenance in this duration due to shortage in the supply of natural gas. As it is more used for domestic purpose in this season.

- Oil prices held steady near three-month highs today, heading for a third consecutive weekly rise, on the back of easing Sino-US trade tensions that have weighed on demand as well as the global economic growth outlook. Brent futures were up 5 cents, or 0.08 per cent, to 66.59 a barrel by 0242 GMT, while US West Texas Intermediate crude was down 8 cents, or 0.13 per cent, at $61.10 per barrel.

- Progress in a long-running trade dispute between the United States and China, the world's two biggest oil consumers, has boosted expectations for higher energy demand next year.

- China on Thursday announced a list of import tariff exemptions for six oil and chemical products from the United States, days after the world's two largest economies announced an interim trade deal set to be signed at the beginning of January.

Iran continues to exports Methanol despite sanctions

- Iran keeps selling its methanol despite US sanctions on the country’s exports. “Our market for methanol exports is guaranteed and we have no worries about exporting this product,” said an Iranian official. he United States has pledged to squeeze Iran’s oil exports – the country’s main source of revenue – to a trickle, but Jahangiri stated that the plan has failed.

- China, which has major methanol-to-olefins capacities, is the key target market for Iranian supplies. Its top five importers account for 60% of Iranian methanol supplies to China.

- India was another major buyer of the Iranian methanol before the United States targeted Iran’s oil, petrochemical, steel, cement and automotive industry with sanctions last year. Iranian methanol shipments also went to Europe, with Italy accounting for the bulk of imports.

$1 = Rs. 71.12

Import Custom Ex. Rate USD/ INR: 71.90

Export Custom Ex. Rate USD/ INR: 70.20