Methanol Weekly Report 18 October 2019

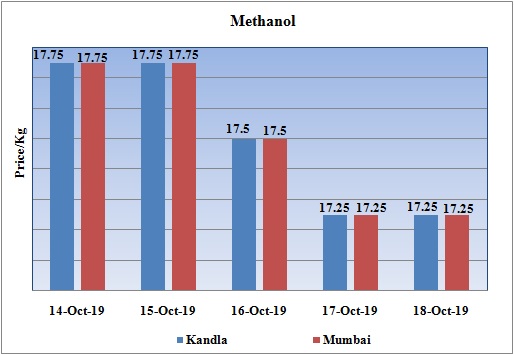

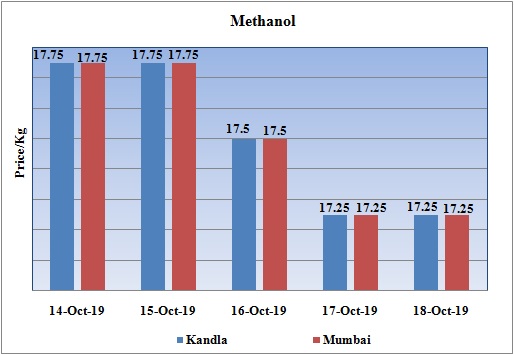

Weekly Price Trend: 14-10-2019 to 18-10--2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained vulnerable throughout this week. Domestic prices were assessed at the level of Rs.17.25/Kg for bulk quantity by end of the week.

- By the end of the week prices were assessed around Rs 17.25/Kg for Kandla and Mumbai ports.

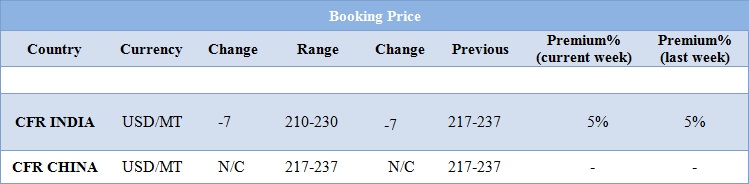

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol remained vulnerable and there was slight slowdown in prices in the starting of week itself. Prices in the domestic market reduced slightly for this week and were assessed at the level of Rs.17.25/Kg for bulk quantity.

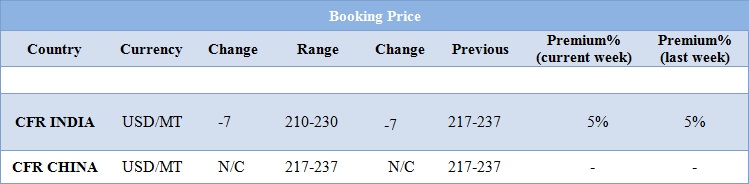

- CFR India prices were assessed around USD 220/MTS, reduced by USD 7/MT for this week.

- CFR China prices were assessed around USD 217-237/MT, with no change in values in compare to last week’s closing values for this week.

- Indian markets are operating on reduced rate as country is festive mood. Next week there will be diwali celebrations across the nation with long extended vacations.

- Benzene the major source for aromatic products also remained unchanged for this week. FOB Korea values for Benzene were assessed around USD 660/MT for this week, while CFR China prices were assessed at the level of USD 670/MT for this week.

- Oil futures finished higher Thursday, as the U.S. and Turkey reached a cease-fire pact in Syria, temporarily easing Middle East tensions, and a tentative Brexit deal fueled appetite for assets perceived as risky.

- Oil prices had traded mostly lower shortly after the Energy Information Administration on Thursday reported that U.S. crude supplies climbed for a fifth week in a row, by 9.3 million barrels for the week ended Oct.

- “Inventories have built by a whopping 9.3 million barrels, led by the refinery utilization rate dropping to its lowest since hurricane Harvey in September 2017.

- A release of 1.3 million barrel has only rubbed salt into the wounds of the bulls, adding to today’s crude build.

- On Thursday, closing crude values have increased. WTI on NYME closed at $53.93/bbl. Prices have increased by 0.57/bbl in compared to last closing prices. While Brent on Inter Continental Exchange is increased by 0.49/bbl in compare to last closing price and was assessed around $59.91/bbl.

Yanchang Petroleum restarted its MTO unit

- MTO unit has been restarted its Methanol-to-Olefins unit after brief maintenance turnaround. Earlier the unit was shut down in the end of August for annual maintenance schedule. The unit resumed its production on 14th October 2019. Unit is based at Shaanxi in China and has the production capacity of Ethylene around 300,000 mt/year and propylene production capacity of 300,000 mt/year.

SABIC to invest in Methanol plant in Russia

- Sabic (Saudi Basic Industries Corporation) has signed a preliminary agreement with the state-controlled Russian Direct Investment Fund and Moscow-based ESN Group for a potential investment in a methanol plant in the Russian Far East. According to Sabic official, "This is an important milestone in our global growth strategy. Russia is important to our global expansion plans, which have been formulated around competitive feedstock and our capacity to innovate and plan strategically.

$1 = Rs. 71.13

Import Custom Ex. Rate USD/ INR: 72.15

Export Custom Ex. Rate USD/ INR: 70.45