Methanol Weekly Report 17 July 2020

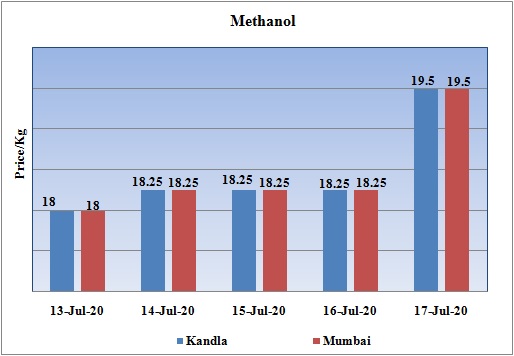

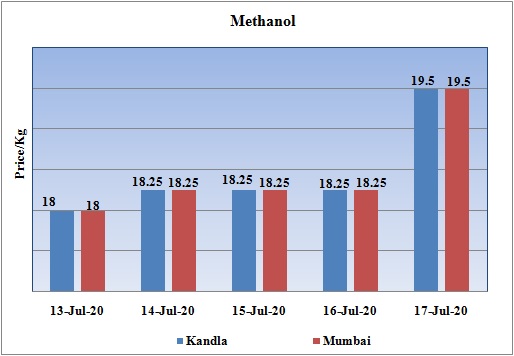

Weekly Price Trend: 13-07-2020 to 17-07-2020

- The above graph focuses on the Methanol price trend for the current week. Prices remained highly variable throughout this week.

- By the end of the week prices were assessed around Rs 19.5/Kg for Kandla and Mumbai ports. It set to be an increase of Rs.1.5/Kg in one week.

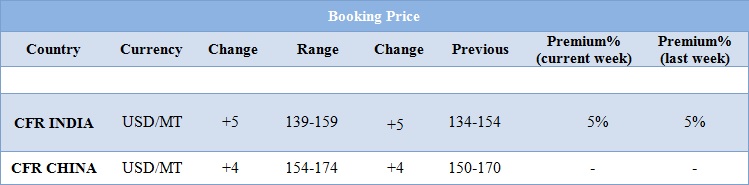

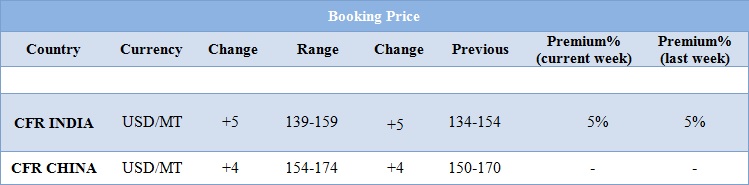

BOOKING SCENARIO

INDIA & INTERNATIONAL

- This week domestic market prices of Methanol have remained vulnerable and were assessed around Rs.19.5/kg for this week for bulk quantity.

- Prices for India were assessed around USD 149/MT, with an increase of USD 5/MT for this week. CFR China prices were assessed around USD 164/MT for this week.

- FOB Korea values were assessed in the range of USD 209-211/MT, increased by USD 3/MT for this week.

- On other side CFR SEA prices were assessed in the range of USD 228-239/MT.

- Zargos Petrochemical Company has shut down its Methanol plant no 2 for maintenance. The unit has been shutdown abruptly due to some technical fault in its operation. It is based at Assalyueh in Iran and has the production capacity of 1.65mn t/yr of methanol. The unit no1 with same capacity is operating at 90% of its capacity.

- Oil prices were broadly stable on Friday in early U.S. trading, as expectations of more economic stimulus programmes balanced concerns about the recovery in fuel demand as coronavirus cases surge and major crude-producing nations ready increases in output.

- Brent crude futures fell 15 cents to $43.22 a barrel by 12:10 EDT (1610 GMT). U.S. West Texas Intermediate (WTI) crude dropped 6 cents to $40.69. Both contracts were on track to remain broadly flat over the week.

- Lawmakers in the United States and the European Union are set to debate the next tranches of stimulus programmes over the coming days. "While virus cases remain on the rise in providing an upside price limiter, expectations for some additional Congressionally driven stimulus appear to be offering support to equities that is spilling into the oil space. Benchmark crudes fell 1% on Thursday after the Organization of the Petroleum Exporting Countries and its allies, a group known as OPEC+, agreed to trim record supply cuts of 9.7 million barrels per day (bpd) by 2 million bpd, starting in August.

$1 = Rs. 75.02

Import Custom Ex. Rate USD/ INR: 76.10

Export Custom Ex. Rate USD/ INR: 74.30