Methanol Weekly Report 12 Aug 2017

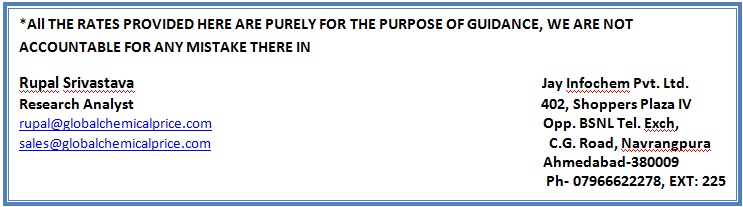

Weekly Price Trend: 07-08-2017 to 11-08-2017

The above graph focuses on the Methanol price trend for the current week. Prices have followed up inclination for this week. By the end of the week prices were assessed around Rs.23.5/Kg for Kandla and Rs 23.5/kg Mumbai ports.

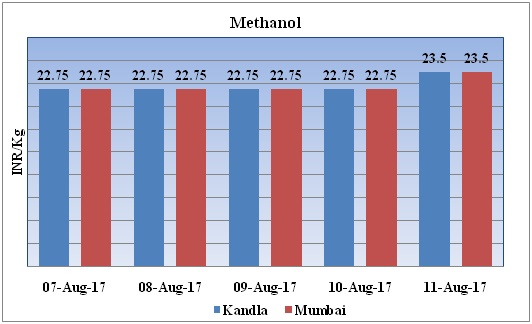

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed up inclination and by the end of the week prices were evaluated at Rs 23.5/kg for Kandla and Rs 23.5/kg for Mumbai ports.

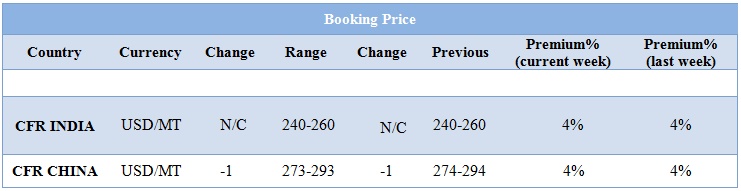

- CFR India prices were assessed in the range of USD 240-260/MTS. Prices have remained firm in compares to previous week.

- This week in China market prices have decreased CFR China prices were assessed in the range of USD 283/mt.

- As per report, Brunei Methanol Company’s methanol plant has been restarted on 5-6 Aug.

- Presently China methanol market shows positive momentum by soaring future offer prices. For future trade methanol market is moving with up velocity.

- Although, those who are too positive for upcoming outlook they have to mull over these spots also.

- Methanol stipulation from downstream sectors such as formaldehyde, MTBE, DME etc. has been bearish on account of environmental protection regulations and in near term also will remain same, anticipated by market participants.

- In China market methanol material availability will be higher in the rest of 2017 as some of new units are on line although some has been shut and demand sentiments from end user sectors will be weaker which will endorse to plunge in the prices.

- This week crude oil prices have followed volatile trend and on Thursday market closed on weak note. Oil prices fell more than 1.5 percent on Thursday, to hit two-week lows, dragged lower by persistent oversupply worries despite a bigger-than-expected drawdown in U.S. crude inventories.

- On Thursday, closing crude values have decreased.WTI on NYME closed at $48.59/bbl, prices have decreased by $0.97/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.80/bbl in compared to last trading and was assessed around $51.90/bbl.

- Investors were also keeping a close eye on the broad market impact of tensions between the United States and North Korea. Recently Crude oil prices failed to hold recent gains, with a nervous market starting to doubt recent falls in inventories.

- As per report, OPEC is curbing output by about 1.2 million bpd, while Russia and other non-OPEC producers cut half as much, until March 2018.

$1 = Rs. 64.13

Import Custom Ex. Rate USD/ INR: 64.55

Export Custom Ex. Rate USD/ INR: 62.85