Methanol Weekly Report 10 Aug 2018

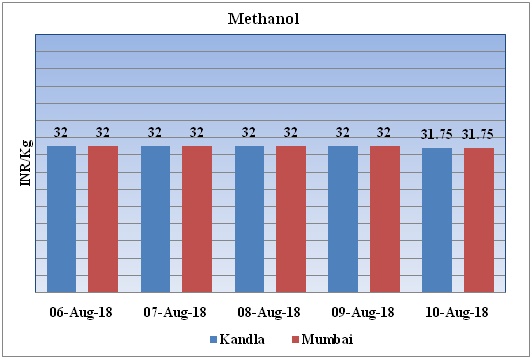

Weekly Price Trend: 06-08-2018 to 10-08-2018

The above graph focuses on the Methanol price trend for the current week. Prices have followed weak trend for this week. By the end of the week prices were assessed around Rs 31.75/Kg for Kandla and Rs 31.75/kg Mumbai ports.

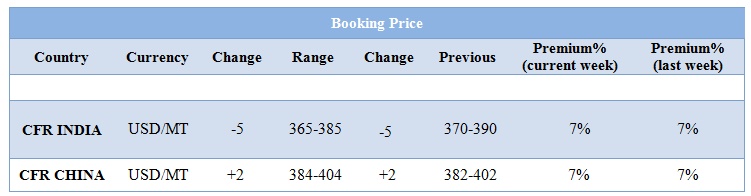

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed weak trend and by the end of the week prices were evaluated at Rs 31.75/kg for Kandla and Rs 31.75/kg for Mumbai ports.

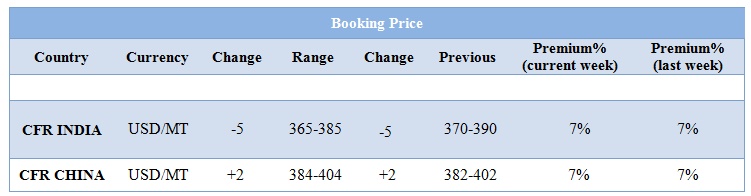

- CFR India prices were assessed in the range of USD 375/MTS. Prices have decreased by USD 5/MT in compares to previous week.

- CFR China prices were evaluated at USD 394/MT. Prices have increased in compare to last week.

- This week on Friday China's methanol futures plunged by 1.70% on bearish sentiment.

- China's Shanghai Huayi Chemical plans to shut its methanol plant for maintenance.

- China’s Mingshui to shut its No 6 methanol plant.

- China has recently threatened to impose 25% tariffs on imports of Methanol from the US. According to sources there will not be any major issue with the tariffs on US methanol. “The current import [volume] from the US is small and for the most part, the supply chain can adjust, with US exports going to other countries, which in turn will displace some cargoes to China," the trader added. China imports more than half of its imported Methanol from Middle East. SO the impact of higher tariffs on US Methanol will have less impact on its pricing.

- As per report, from the start of August within 10 days China methanol futures on Zhengzhou Commodity Exchange have escalated sharply due to depreciation of Chinese yuan and Us trade friction.

- As per report, Methanol inventory does not increase as expected and profits of downstream derivatives are recovering, which drive methanol price higher. In addition, methanol inventory in domestic plants remains low this year. Though July-August is slack demand season in downstream industry, product inventory in inland plants does not increase, as materials are sold to coastal regions due to the high price spread.

- Some market players said that domestic plants are restarting, and methanol supply is expected to increase. After the rise in methanol price, downstream derivatives could see lower profits. resulted, methanol market is under pressure in China.

- This week oil prices have followed volatile trend. On Thursday Crude prices held near lower levels set in the previous session, as the escalating China-U.S. trade dispute cast doubt on the outlook for oil demand.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $66.81/bbl. Prices have decreased by $0.13/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.21/bbl in compare to last closing price and was assessed around $72.07/bbl. Both benchmarks tumbled more than 3 percent after U.S. data showed a smaller-than-expected weekly draw in crude inventories and a surprise build of 2.9 million barrels in gasoline supplies.

$1 = Rs. 68.87

Import Custom Ex. Rate USD/ INR: 69.25

Export Custom Ex. Rate USD/ INR: 67.55