Methanol Weekly Report 03 Feb 2018

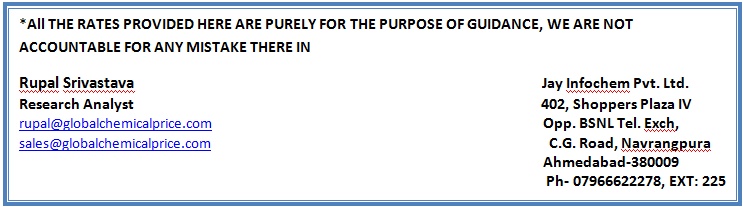

Weekly Price Trend: 29-01-2018 to 02-02-2018

The above graph focuses on the Methanol price trend for the current week. Prices have followed volatile trend for this week. By the end of the week prices were assessed around Rs 29.25/Kg for Kandla and Rs 29.25/kg Mumbai ports.

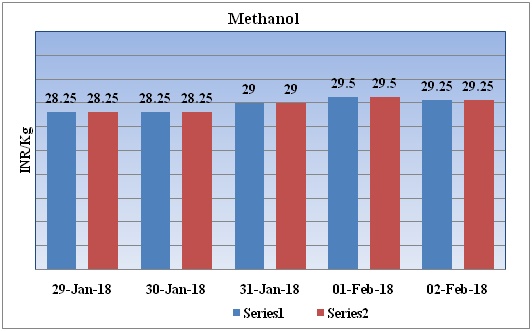

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed volatile trend and by the end of the week prices were evaluated at Rs 29.25/kg for Kandla and Rs 29.25/kg for Mumbai ports.

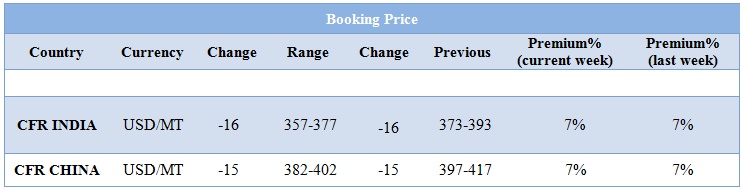

- CFR India prices were assessed in the range of USD 357-377/MTS. Prices have decreased sharply by USD 16/mt in compares to previous week.

- This week methanol prices have plunged on bearish demand sentiments from end users.

- CFR China prices of methanol were evaluated at USD 392/mt.

- FOB Korea prices of Methanol were evaluated USD 430/mt.

- China’s Shandong Rongxin methanol plant shutdown.

- Methanex to add plants in US, Canada but timing uncertain.

- Canada based Methanex has announced its ACPC for the month of February 2018. It has increased its contract prices for this month by USD 10/MTS. Asian Contract prices are posted at USD 480/MTS. Prices posted for the region of Europe around Euro 380/MT, remained unchanged for this month.

- As per market players currently methanol market is moving with uncertain velocity on account of this some players have adopted wait and observe stances.

- In China market, industry players are buying only need based material on upcoming holiday market have been bearish.

- Moreover, in domestic market demand sentiments have been escalating.

- This week oil prices have followed volatile trend. Goldman Sachs on Thursday raised its 2018 oil price forecasts, projecting that Brent crude will soon top $80, fueled by blockbuster oil demand, a deal among big producers to limit output and U.S. drillers' inability to meet the world's growing energy appetite.

- On Thursday, closing crude values have increased. WTI on NYME closed at $65.80/bbl; prices have increased by $1.07/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.03/bbl in compared to last trading and was assessed around $69.08/bbl.

$1 = Rs. 64.06

Import Custom Ex. Rate USD/ INR: 64.50

Export Custom Ex. Rate USD/ INR: 62.85