MEG Weekly Report 8 April 2017

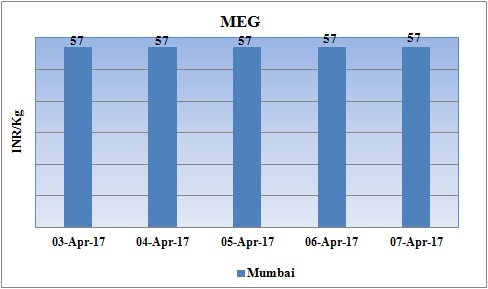

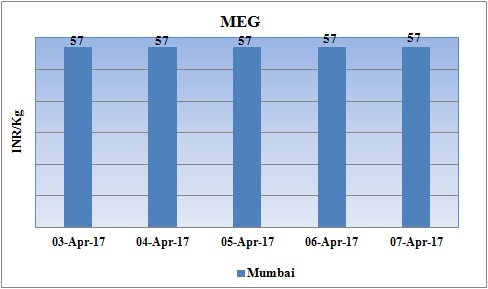

Weekly Price Trend: 03-04-2017 to 07-04-2017

- The above given graph focuses on the MEG price trend from 3rd April to 7th April 2017.

- Prices reduced heavily for this week. Domestic prices were assessed at the level of Rs.57/Kg for bulk quantity by end of the week. Since past few weeks there has been constant decline in domestic values of MEG.

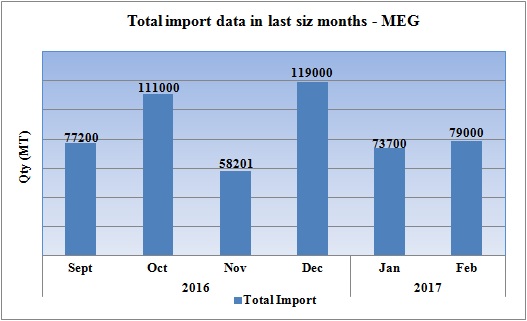

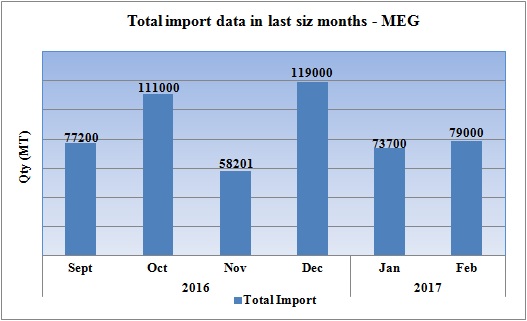

Total import at various ports in last six months

The above chart depicts the total amount of MEG in the span of last six months.

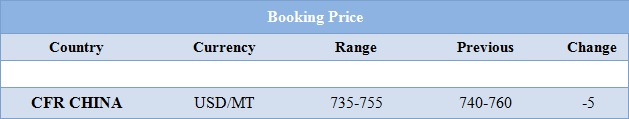

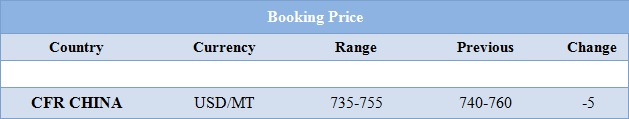

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices reduced by Rs.5/Kg for bulk quantity.

- CFR India prices were assessed in the range of USD 940-960/MTS. Prices remained unchanged for this week.

- CFR China values decreased by USD 5/MTS in compare to last week’s assessed values and were assessed in the range of USD 735-755/MT

- CFR SEA prices for MEG were assessed around USD 750/MT for this week. There has been slight reduction of USD 5 in compare to last week’s closing values.FOB Korea values for Ethylene were assessed around USD 1095/MTS while CFR China values for Ethylene were assessed around USD 1095/MTS.

- FOB Korea values for Propylene was assessed around USD 820/MTS while CFR China values were assessed around USD 845/MTS.

- In the beginning of this week oil prices remained weak but as the days passed prices gained the momentum. On Tuesday prices declined slightly but again as the week preceded prices remained upright. This rise was on back bullish market sentiments. Although oil prices have increased but market players remained vigilant about record-high U.S. crude inventories

- On Friday U.S. crude futures jumped more in compare to Asia as President Trump ordered the first direct American military action against the regime of Syrian President Bashar al-Assad.

- Presently traders have been watching U.S. gasoline inventories as an indicator of what may happen with crude supplies.

- As per market analysts, the dollar has come under some pressure of late and this pushes up oil as well as the U.S. dollar value for offshore earnings. Traders believe that oil is likely to remain in its recent wide range. OPEC Secretary said that that the oil market is already rebalancing and global oil inventories are starting to come down after three months of output cuts by OPEC and their 11-non-OPEC partners. While rising U.S. crude production has some OPEC members calling for an extension of the cuts through December.

- On Thursday, closing crude values have increased.WTI on NYME closed at $51.70/bbl, prices have increased by $0.55/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.53/bbl in compared to last trading and was assessed around $54.89/bbl.

$1 = Rs. 64.28

Import Custom Ex. Rate USD/ INR: 65.90

Export Custom Ex. Rate USD/ INR: 64.20