MEG Weekly Report 27 Oct 2018

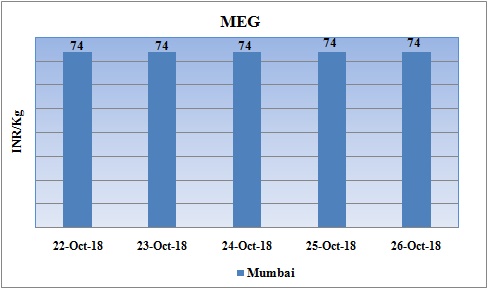

Weekly Price Trend: 22-10-2018 to 26-10-2018

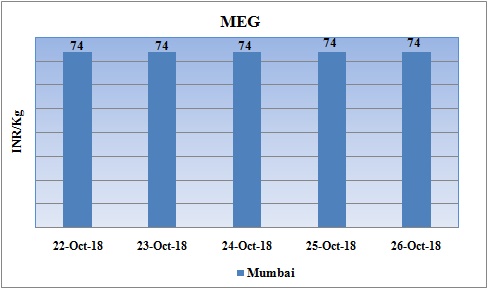

- The above given graph focuses on the MEG price trend from 22nd Oct to 26th Oct 2018.

- Domestic prices remained firm with rise in values for this week. Domestic prices were assessed at the level of Rs.75/Kg for bulk quantity.

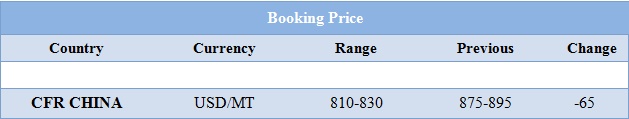

Booking Scenario

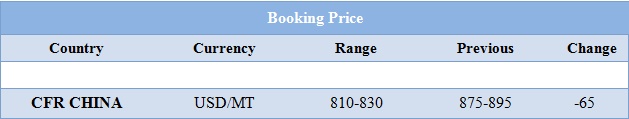

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained weak for bulk quantity. Prices were assessed at the level of Rs.74/Kg for bulk quantity.

- CFR China values were assessed around USD 810-830/MT, heavily reduced by USD 65/MT for this week. CFR South East Asia assessed around USD 835/MT. CFR India price were assessed around USD 850/MT.

- FOB Korea values for Ethylene reduced heavily for this week and were assessed around USD 1065/MT, while CFR China values were assessed around USD 1055/MT and CFR South East Asia values were assessed around USD 965/MT.

- On other side Propylene market also reduced significantly for this week. FOB Korea values were assessed around USD 1110/MT while CFR China values were assessed around USD 1150/MT.

- Oil prices reduced on Friday and were heading for a third weekly loss, pulled down as Saudi Arabia's OPEC governor said the market may become oversupplied soon and after a slump in global equities clouded the outlook for demand. "Bearish sentiment could force a re-test of support in the low $70.0 per barrel range.

- The market may shift towards an oversupply situation as evidenced by rising inventories over the past few weeks.

- U.S. crude oil stockpiles rose last week for the fifth consecutive week, while gasoline and distillate inventories fell, the Energy Information Administration said this week.

- Financial markets have been hit hard by a range of worries, including the U.S.-China trade war, a rout in emerging market currencies, rising borrowing costs and bond yields, and economic concerns in Italy.

- Washington is putting pressure on governments around the world to stop importing oil from Iran. Most, including its biggest customer China, are falling in line, and Iran has turned to storing its unsold oil on its tanker fleet in the hope that it can sell the crude off quickly once the sanctions are lifted again.

PLANT NEWS

Naphtha cracker restarted by Idemitsu Kosan

Idemitsu Kosan has restarted its naphtha cracker after brief maintenance period. Earlier the unit was shut in the first week of September. The cracker remained off-stream for around 4-5 weeks.

Unit is based at Tokuyama in Japan and has the production capacity of Ethylene around 6,90,000 mt/year.

Cracker restarted by Exxon Mobil at Singapore

Exxon Mobil its cracker unit after brief maintenance schedule. The cracker was restarted this week. Earlier the unit was shut down in the first week of September 2108.

Unit is based at Jurong island in Singapore and has the production capacity of Ethylene around 9,00,000 mt/year.

PTTGlobal restarted its cracker unit

PTTGloabal has restarted its cracker unit no1 this week. Earlier the unit was shut down annual maintenance turnaround. Te unit remained off-stream for around three weeks. Unit is based at Map Ta Phut in Thailand and has the production capacity of ethylene around 460,000 mt/year and a propylene production capacity of 125,000 mt/year.

$1 = Rs. 73.46

Import Custom Ex. Rate USD/ INR: 74.30

Export Custom Ex. Rate USD/ INR: 72.60