MEG Weekly Report 15 April 2017

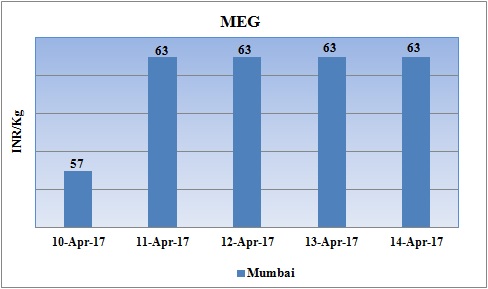

Weekly Price Trend: 10-04-2017 to 14-04-2017

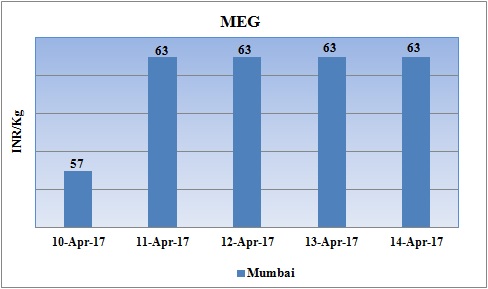

- The above given graph focuses on the MEG price trend from 10th April to 14th April 2017.

- Prices recovered significantly heavily for this week. Domestic prices were assessed at the level of Rs.63/Kg for bulk quantity with an increase of Rs.6/Kg by end of the week. After significant decline in last few weeks this has been slight improvement in domestic values for this week.

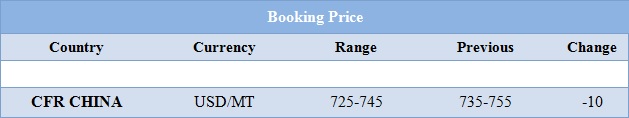

Booking Scenario

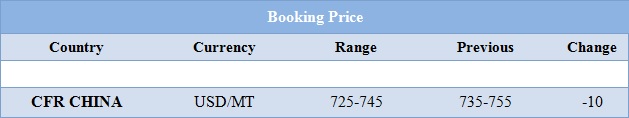

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices increased by Rs.6/Kg for bulk quantity.

- CFR India prices were assessed in the range of USD 940-960/MTS. Prices remained unchanged for this week.

- CFR China values decreased by USD 10/MTS in compare to last week’s assessed values and were assessed in the range of USD 725-745/MT

- CFR SEA prices for MEG were assessed around USD 740/MT for this week. There has been slight reduction of USD 5 in compare to last week’s closing values. FOB Korea values for Ethylene were assessed around USD 1125/MTS while CFR China values for Ethylene were assessed around USD 1170/MTS.

- FOB Korea values for Propylene was assessed around USD 810/MTS while CFR China values were assessed around USD 825/MTS.

- Lotte Chemical Titan is operating its no 2 cracker unit at full capacity. The units are operating at 98% of its production capacity. Earlier the unit was shut down in the month of February for brief maintenance last week. The unit resumed its operations last week.

- Later in this week the unit no1 and no2 was shut down on back of cut in water supply. Although lately in the week water supply resumed but operations at the cracker are still halted.

- Cracker is based at Pasir Gudang in Malaysia and the No. 1 cracker can produce 260,000 mt/year of ethylene and 160,000 mt/year of propylene while the No. 2 cracker can make 407,000 mt/year of ethylene and 260,000 mt/year of propylene.

- Severe volatility was observed in the crude prices for this week. Still the market sentiments by end of the week remained strong with prompting crude prices to close on higher note. Yesterday some stability was seen global oil market as demand and supply was on matching hand due to fall in the stockpiles in developed nations in the month of March.

- According to recent reports, the market has been oversupplied since last three years, prompting members of the OPEC and some non-OPEC producers to agree to cut output in the first six months of 2017 to rein in the glut. OPEC meets on May 25 to consider extending the cuts beyond June.

- On other side there has been continuous rise in oil production in U.S., both onshore and offshore, which will act as a headwind for the market.

- As per market analyst, refinery runs are picking up, and driving season is around the corner, so inventories will start going down soon. Amid so much uncertainty, the only thing that is certain is that crude oil production is growing, and there are no signs that this will change while the going is good and prices stay above $50 a barrel.

- On Thursday, closing crude values have increased.WTI on NYME closed at $53.18/bbl, prices have increased by $0.07/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.03/bbl in compared to last trading and was assessed around $55.89/bbl.

$1 = Rs. 64.41

Import Custom Ex. Rate USD/ INR: 65.90

Export Custom Ex. Rate USD/ INR: 64.20