MEG Weekly Report 13 Oct 2018

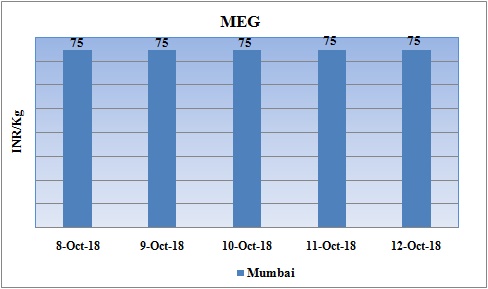

Weekly Price Trend: 08-10-2018 to 12-10-2018

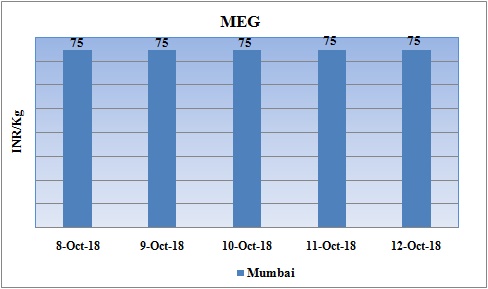

- The above given graph focuses on the MEG price trend from 8th Oct to 12th Oct 2018.

- Domestic prices remained firm with no change in values for this week. Domestic prices were assessed at the level of Rs.75/Kg for bulk quantity.

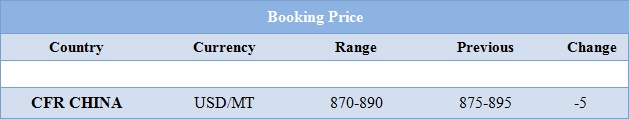

Booking Scenario

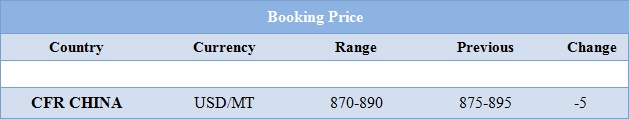

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained weak for bulk quantity. Prices were assessed at the level of Rs.75/Kg for bulk quantity.

- CFR China values were assessed around USD 870-890/MT, slightly reduced by USD 5/MT for this week. CFR South East Asia assessed around USD 895/MT. CFR India price were assessed around USD 900/MT.

- FOB Korea values for Ethylene improved for this week and were assessed around USD 1190/MT, while CFR China values were assessed around USD 1165/MT and CFR South East Asia values were assessed around USD 1065/MT.

- On other side Propylene market increased for this week. FOB Korea values were assessed around USD 1135/MT while CFR China values were assessed around USD 1195/MT.

- In compare to MEG values prices for Ethylene and Propylene has reduced heavily in the international market.

- Last week there was strong rally for crude prices and was expected to cross the mark of USD 100/bbl very soon. But this week scenario was totally different. Brent crossed the mark of $86 on Tuesday , lowered in last two days on back of investors sell off in the trading.

- The main story driving the oil market remains the loss of Iranian crude exports ahead of the full renewal of U.S. sanctions on Nov. 4. That deadline is still frightening large over the market and could help push oil prices back up.

- All the major nations unanimously agree that with Iran sanctions, a large chunk of oil will be removed from the market. How strong its impact is beyond everybody’s imaginations.

- Emerging markets like India are really struggling with higher oil prices coupled with continuous currency depreciation.

- Indian Rupee has depreciated more than by 15% year-to-date. Higher crude oil prices, demand from defense and oil marketing firms have contributed to the latest bout of weakness. Rupee was overvalued on trade weighted real effective exchange rate.

- China market is also facing the heat of rise in crude prices and deprecation of its own currency. Further the trade tariffs with US will affect the Chinese economy in long run. To check its impact China’s Central Bank has cut down the reserve requirement ratios (RRRs) by one per cent from October 15 which will inject a net USD 109.2 billion in cash into the banking system.

- Yanbu National Petrochemical Co (Yansab) is planning for maintenance of its Ethylene Glycol unit for around 66 days. The unit will go off-stream on 22nd Oct 2018. Financial impact of the shutdowns is estimated at SAR 180 million based on average prices, and is expected to show in Q4 2018 and Q1 2019 results, Yansab said.

$1 = Rs. 73.54

Import Custom Ex. Rate USD/ INR: 74.60

Export Custom Ex. Rate USD/ INR: 72.90