MEG Weekly Report 11 March 2017

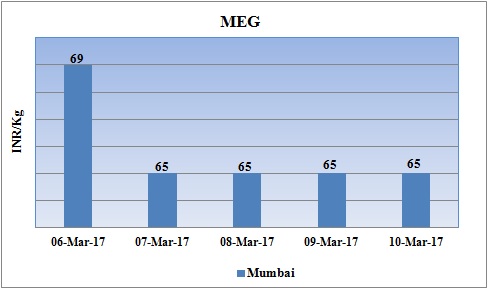

Weekly Price Trend: 06-03-2017 to 10-03-2017

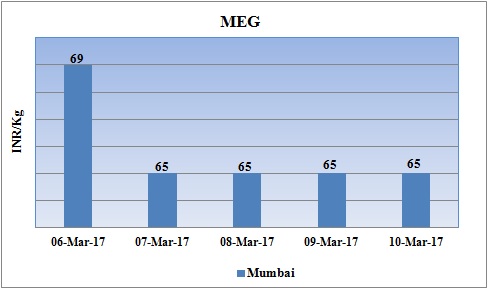

- The above given graph focuses on the MEG price trend from 6th March to 10thMarch 2017.

- Prices reduced heavily in compare to last week’s closing values. Domestic prices were assessed at the level of Rs.65/Kg for bulk quantity by end of the week. Since past few weeks there has been constant decline in domestic values of MEG.

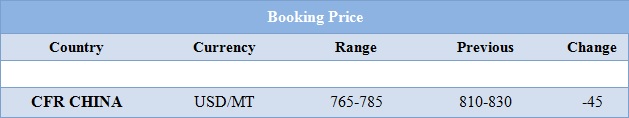

Booking Scenario

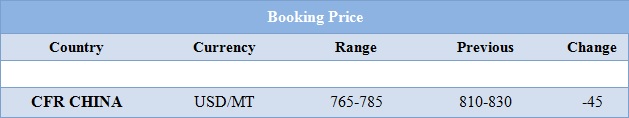

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices reduced heavily for bulk quantity. Prices were reduced by Rs.4/Kg for this week and were assessed around Rs.65/Kg for bulk quantity.

- CFR India prices were assessed in the range of USD 1040-1060/MTS. Prices remained unchanged for this week.

- CFR China values declined by USD 45/MTS in compare to last week’s assessed values and were assessed in the range of USD765-786/MT

- CFR SEA prices for MEG were assessed around USD 780/MT for this week. There has been reduction by USD 40/MTS in compare to last week’s closing values. FOB Korea values for Ethylene were assessed around USD 1295/MTS while CFR China values were assessed around USD 1095/MTS.

- CFR China Propylene values were assessed around USD 940/MTS while FOB Korea prices were assessed around USD 915/MTS.

- There has been toppling of crude values in this week. In last five days US oil prices plunge by 7.5% while Brent oil sink by 6.6% as record U.S. crude inventories fed doubts about whether OPEC-led supply cuts would reduce a global glut.

- According to reports, declining oil prices have helped U.S. and global energy companies to get back into the investing mode but yet experts believe that there's not enough money going into longer-term projects and if things don't change, oil prices could spike and supply could be short.

- Market players foresee for OECD oil stocks to decline significantly this year will help the large OPEC cuts and robust global demand growth, to consider the recent drop in crude oil prices to be a good opportunity to enter into bullish option structures.

- On Thursday, closing crude values have plunged.WTI on NYME closed at $49.28/bbl, prices have decreased by $1.00/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.92/bbl in compared to last trading and was assessed around $52.19/bbl.

$1 = Rs. 66.60

Import Custom Ex. Rate USD/ INR: 67.65

Export Custom Ex. Rate USD/ INR: 66.00