MEG Weekly Report 02 Dec 2017

Weekly Price Trend: 26-11-2017 to 01-12-2017

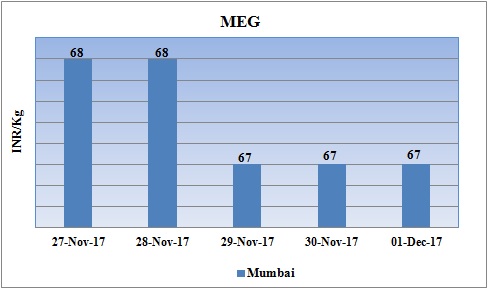

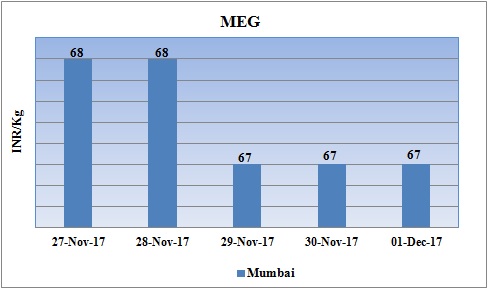

- The above given graph focuses on the MEG price trend from 27th Nov to 1st Dec 2017.

- Prices slightly decreased for this week. Domestic prices were assessed at the level of Rs.67/Kg reduced by Rs.1/Kg sin compare to last week’s closing values.

Booking Scenario

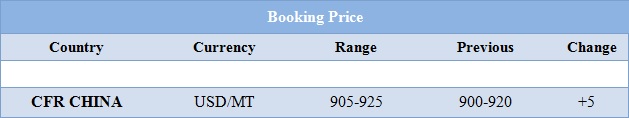

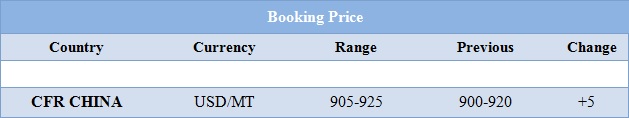

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices reduced slightly with a slowdown of Rs.1/Kg for bulk quantity. Prices were assessed at the level of Rs.67/Kg for bulk quantity.

- CFR China values were assessed around USD 905-925/MT, increased by USD 5/MTS in compare to last week’s assessed values.

- CFR China Ethylene values were assessed around USD 1295/MT while FOB Korea values were assessed around USD 1250/MT.

- CFR China Propylene values were assessed around USD 970/MT while FOB Korea values were assessed around USD 895/MT.

- Kuwait’s Petrochemicals Equate Petrochemical has restarted its MEG unit recently. Earlier the unit was shut down in first week of November for annual maintenance. The unit is based in Kuwait and has the production capacity of 615 Kt/year.

- Kuwait Olefins Co has restarted production at its cracker post brief maintenance schedule. Earlier the unit was shut down in last week of October for annual maintenance schedule. Unit is based at Shuaiba in Kuwait and has the Ethylene production capacity of 85,000 mt/year.

- This week crude oil prices have followed mixed trend. On Thursday oil prices have escalated OPEC members, Russia and nine other producers agreed to extend a deal to limit their production through 2018.

- On Thursday, closing crude values have increased. WTI on NYME closed at $57.40/bbl; prices have decreased by $0.10/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.46/bbl in compared to last trading and was assessed around $63.57/bbl

- As per report, the producers will indeed review the deal at the next OPEC meeting in June. Some markets were concerned that a nine-month extension could cause markets to quickly tighten, leading to undersupply that results in a price spike. Oil watchers also warn that a rise in prices will give U.S. shale drillers an incentive to flood the market. Russia has expressed concern that its oil companies will continue to lose market share to American producers, who are exporting record levels of crude.

$1 = Rs. 64.46

Import Custom Ex. Rate USD/ INR: 66.20

Export Custom Ex. Rate USD/ INR: 64.50