Maleic Anhydride Weekly Report 26 May 2018

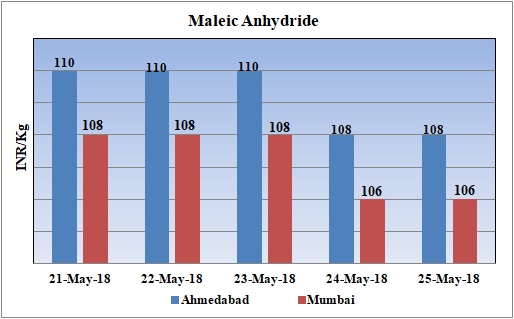

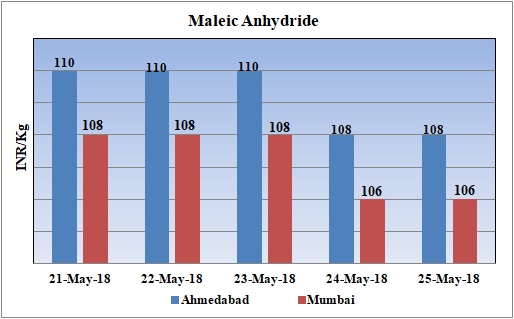

Weekly Price Trend: 21-05-2018 to 25-05-2018

- The above given graph focuses on the Maleic Anhydride price trend for the current week.

- This week, there has been slowdown in the domestic prices.

- Prices were assessed at the level of Rs.106-108/Kg for Ahmedabad and Mumbai regions.

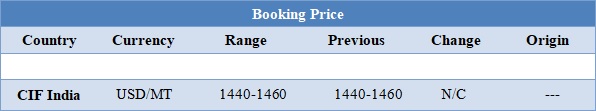

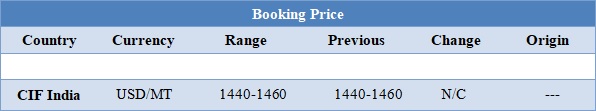

Booking Scenario

The above chart shows the international price of Maleic Anhydride for this week. It shows that the prices for Maleic Anhydride have remained firm for this week.

INDIA & INTERNATIONAL

- Maleic Anhydride prices remained weak for this week. Prices were assessed at the level of Rs.106-108/Kg for Ahmedabad and Mumbai for bulk quantity.

- International prices have remained stable for this week.

- CIF India prices of Maleic Anhydride were assessed at the level of USD 1440-1460/MT, for Taiwan origin material, with no change for this week.

- There has been significant hike in Maleic Anhydride price in Asian market as supply glut has been the major factor. Strong demand from Europe and India has been the dominating factor in rise in prices. CFR SEA prices were assessed in the range of USD 1440-1460/MT. Demand from the downstream sector has been the prominent on last few weeks.

- In the Indian market there has been big leap in the values on back of delay in the shipment for last few weeks.

- This week oil prices have followed volatile trend. On Thursday, prices plunged, by the prospect of the first increase in OPEC output since 2016 in the face of concern over supply from both Venezuela and Iran, while a surprise rise in U.S. crude inventories raised doubt over seasonal demand.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $70.71/bbl; prices have decreased by $1.13/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $1.01/bbl in compared to last trading and was assessed around $78.79/bbl.

- This discussion about possible OPEC supply increases after the June meeting has put a brake on the oil price for the time being, so $80 is a big hurdle to overcome. If prices get above there, that will further intensify and increase the likelihood that OPEC will do something. It's going to be very difficult to overcome this level on a sustainable basis before the OPEC meeting.

- As per report, the OPEC may decide at its meeting in June to increase oil output to make up for reduced supply from Iran and Venezuela and in response to concerns from Washington over a rally in oil prices. OPEC and some non-OPEC major oil producers are scheduled to meet in Vienna on June 22.

$1 = Rs. 67.75

Import Custom Ex. Rate USD/ INR: 68.65

Export Custom Ex. Rate USD/ INR: 66.95