ACN Weekly Report 17 Feb 2018

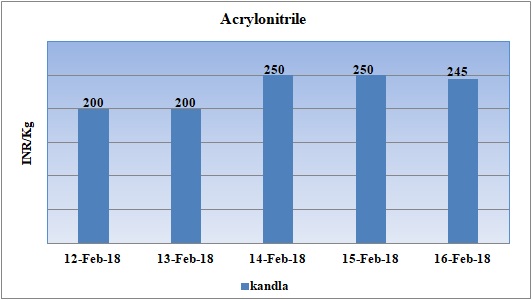

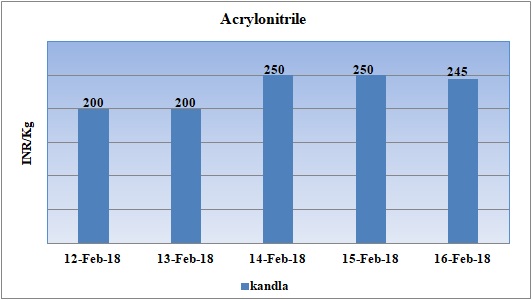

Weekly Price Trend: 12-02-2018 to 16-02-2018

- The above given graph focuses on the ACN price trend from 12th Feb to 16th Feb 2018. In compare to last week’s closing values there has been bulk hike in domestic values. Prices increased by Rs.45/Kg in domestic market. In last two weeks prices for ACN has increased by Rs.100/Kg for bulk quantity.

- Domestic prices increased heavily due to limited supply of chemical in the domestic and international market.

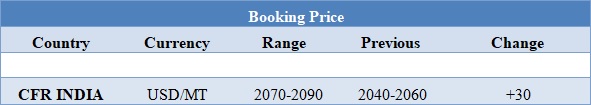

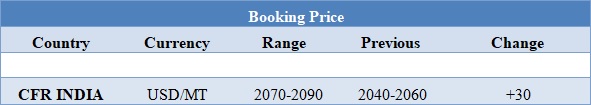

Booking Scenario

The above chart shows the international prices of ACN. CFR India prices of ACN were assessed in the range of USD 2070-2090/MT.

INDIA& INTERNATIONAL

- After an unprecedented hike in values in last few months the domestic values has been increased further this week. Prices of ACN were assessed around Rs245/Kg, increased by Rs.45/Kg for bulk quantity in span of one week.

- CFR India prices of Acrylonitrile were assessed in the range of USD 2070-2090/MT, increased by USD 30/MTS in compare to last week’s closing values.

- There has been override in ACN prices in Asian markets since last few weeks. The tightening in the supply has been the sole reason for this gain. The Indian traders are at the worst end as prices are increasing significantly since last few weeks. Further many manufacturers are storing the material for future use as well as many ACN manufacturing units is likely to undergo maintenance schedule in the month of April and May.

- The majority of ACN imported is used by AF sector in India. The AF manufacturers are facing troublesome time as their margins are reduced to significant level and they cannot afford this hike in ACN values.

- CFR South East Asia prices were assessed at the USD 1875-1895/mt levels. CFR South Asia prices were assessed higher at the USD 1910-1930/mt levels. The price gain was in line with continued tight product availability coupled with bullish buying interest in the region.

- Feedstock Propylene market has also been witnessing firmness in prices. FOB Korea values were assessed around USD 1055/MT while CFR China values were assessed around USD 1110MT. With maintenance scheduled in the month of January more progression in values will take place in next few months in Asian markets.

- China market remained closed due to Lunar holidays. The activities will resume only after 21st Feb 2018.

- South Korea based Taekwang Industrial has shut down its ACN unit for maintenance turnaround. The unit has been shut down for maintenance schedule.

- Unit is based at Uslan in South Korea and has the production capacity of 2,90,000 mt/year.

- China market remained closed due to Lunar holidays. The activities will resume only after 21st Feb 2018.

- This week oil prices have followed volatile trend. Oil prices extended gains on Thursday as a weak dollar and supportive comments from Saudi Arabia outweighed record U.S. production and rising inventories.

- On Thursday, closing crude values have remained mixed. WTI on NYME closed at $61.34/bbl; prices have increased by $0.74/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.03/bbl in compared to last trading and was assessed around $64.33/bbl.

- On Friday Oil prices edged higher as the dollar stood near a three-year low in subdued Asian trade, with many markets closed for the Lunar New Year holiday.

- As per market players, Oil is getting support from a rebound in global stock markets and a weak dollar, but the upside is limited due to a projection for rising U.S. production.

$1 = Rs. 64.21

Import Custom Ex. Rate USD/ INR: 64.40

Export Custom Ex. Rate USD/ INR: 62.85