Acetic Acid Weekly Report 27 Oct 2018

Weekly Price Trend: 15-10-2018 to 19-10-2018

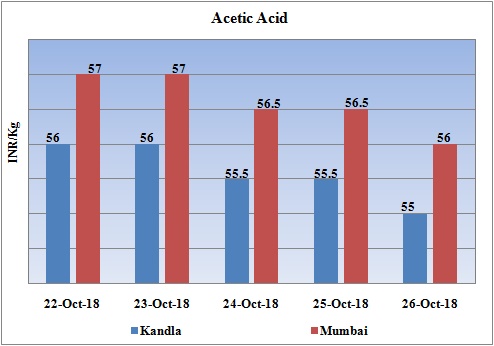

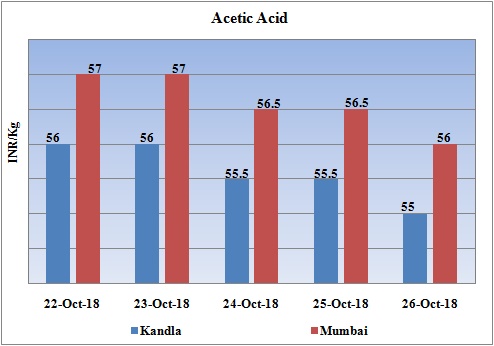

- The above given graph focuses on the Acetic Acid price trend from 22nd Oct 2018 to 26th Oct 2018. If we take a quick look at the above given weekly prices, it can be observed that prices remained soft-to-stable for this week.

- With continuous variability in crude values prices and depreciating currency has affected domestic market significantly. In compare to last week there has been decline in domestic prices.

- By end of this week, prices were assessed at the level of Rs.55/Kg for Kandla and for Rs. 56/Kg for Mumbai port for bulk quantity.

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid assessed around Rs.55/Kg for Kandla and Rs.56/Kg for Mumbai port of India. Prices have remained vulnerable throughout this week.

- There has been This week initially prices remained firm week in domestic market as the week proceeded further there was an upright increase in domestic values. The other major reason for this increase the hike in the values for Methanol in domestic market.

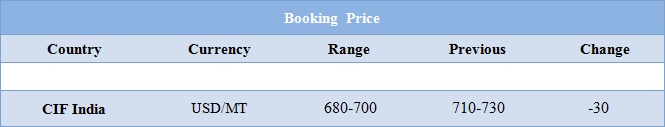

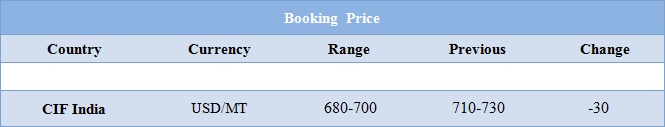

- CIF India prices for Acetic Acid were assessed around USD 680-790/MT reduced by USD 30/MT in compare to last week’s closing values.

- Oil prices reduced on Friday and were heading for a third weekly loss, pulled down as Saudi Arabia's OPEC governor said the market may become oversupplied soon and after a slump in global equities clouded the outlook for demand. "Bearish sentiment could force a re-test of support in the low $70.0 per barrel range.

- The market may shift towards an oversupply situation as evidenced by rising inventories over the past few weeks.

- U.S. crude oil stockpiles rose last week for the fifth consecutive week, while gasoline and distillate inventories fell, the Energy Information Administration said this week.

- Financial markets have been hit hard by a range of worries, including the U.S.-China trade war, a rout in emerging market currencies, rising borrowing costs and bond yields, and economic concerns in Italy.

- Washington is putting pressure on governments around the world to stop importing oil from Iran.

- Most, including its biggest customer China, are falling in line, and Iran has turned to storing its unsold oil on its tanker fleet in the hope that it can sell the crude off quickly once the sanctions are lifted again.

1$ : Rs. 73.46

Import Custom Ex. Rate USD/ INR: 74.30

Export Custom Ex. Rate USD/ INR: 72.60