Acetic Acid Weekly Report 22 May 2020

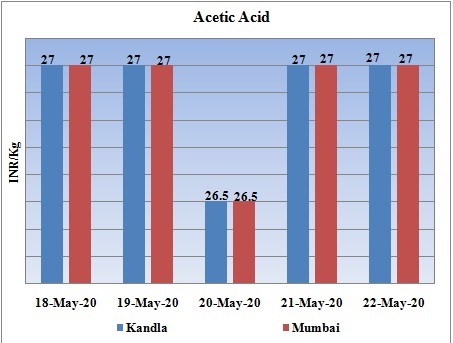

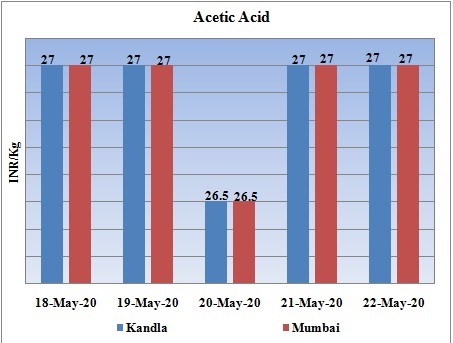

Weekly Price Trend: 18-05-2020 to 22-05-2020

- The above given graph focuses on the Acetic Acid price trend from 18th May to 22nd May 2020. If we take a quick look at the above given weekly prices, it can be observed that prices has been volatile throughout this week.

- The market trend has been under significant pressure with complete confusion due to lockdown. Slowly units are reopening but the issue of non availability of labour has been pinching the small manufacturers and traders across the nation.

- By end of the week prices were assessed at the level of Rs.27/Kg, with minor change in values for this week.

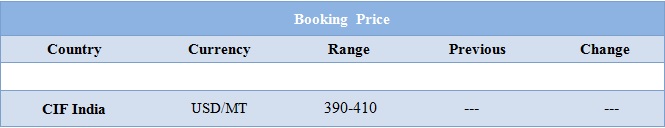

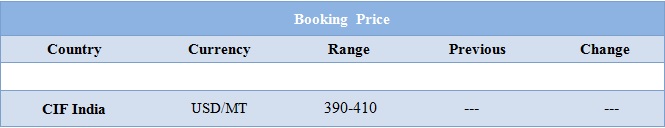

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid were assessed around Rs.27/Kg for Kandla and for Mumbai ports of India.

- CIF India prices for Acetic Acid were assessed around USD 390-410/MT for this week.

- Oil prices headed high today for a fourth straight week of gains, indicating that there has been improvement in the demand for fuel as many countries across the world has started to give relaxation in the social restriction and lockdown which was earlier imposed due to coronavirus pandemic.

- On Thursday, closing crude values have increased. WTI on NYME closed at $33.92/bbl. Prices have increased by 0.43/bbl in compared to last closing prices. While Brent on Inter Continental Exchange is increased by 0.31/bbl in compare to last closing price and was assessed around $36.06/bbl.

- All the economies of the world have been affected significantly by this Covid 19. The blow is at its height globally and will incur heavy joblessness in the countries.

- Moreover no vaccine has been yet fully developed against the novel coronavirus disease, which originated late last year in China and is now on its fifth month of deadly rampage across the globe.

- Further now Indian government has decided to impose 15% tax on imports of all chemicals and petrochemical to protect the domestic industry in the current fiscal year.

- Downstream end-users, however, have posed strong opposition to the measure dubbed as “covid (coronavirus disease) tax” - which was supposed to take effect for 11 months from May 2020 - as this will translate to higher cost of production.“Due to the current global crisis, consumer demand is going to be suppressed. However, lower price of polymer, and therefore, affordable plastics finished products could drive up the demand and hence, could help to retain nearly 5m jobs in plastics processing sector,” he added.

- This would help improve demand and also create more jobs in the plastics processing sector, which is dominated by micro, small and medium enterprises (MSMEs). “More than 50,000 MSME plastic processors in India have installed capacity to process 55m tonnes and have been operating at 50% capacity due to demand depression,” the AIPMA member said. “If the recommendation to increase taxes on chemicals is accepted, thousands of MSME’s would close down leading to massive job losses and financial pain.

1$: Rs. 75.95

Import Custom Ex. Rate USD/ INR: 76.60

Export Custom Ex. Rate USD/ INR: 74.90