Acetic Acid Weekly Report 20 March 2020

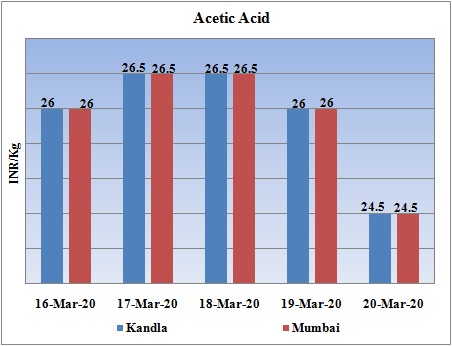

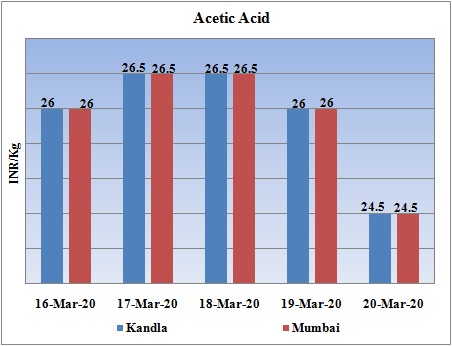

Weekly Price Trend: 16-03-2020 to 20-03-2020

- The above given graph focuses on the Acetic Acid price trend from 16th March to 20th March 2020. If we take a quick look at the above given weekly prices, it can be observed that prices has been volatile throughout this week.

- There has been nosedive decline in the prices in the starting of week itself. Later on there was an improvement in domestic prices.

- By end of the week prices were assessed at the level of Rs.24.5/Kg, with no change in values for this week.

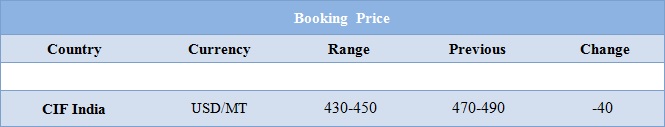

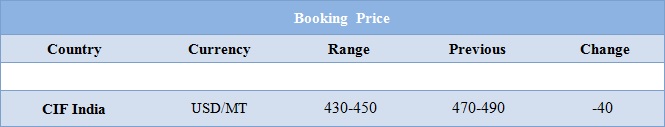

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid were assessed around Rs.27/Kg for Kandla and for Mumbai ports of India.

- CIF India prices for Acetic Acid were assessed around USD 430-450/MT, reduced by USD 40/MTS for this week.

- Prices for Methanol on other side have reduced significantly for this week. Prices were assessed around USD 179/MT reduced by USD10/MT for this week.

- Major economic city of India, Mumbai has been locked down since Friday amid Corona scare. Many other cities are likely to undergo complete lockdown in next week. The country will be under curfew on Sunday suspending all sorts of activities across the nation.

- Indian markets plunge as pandemic fears drive investors into panic selling mode, Brent crude hits a 16-year low; analysts now see a long recession.

- After scaling new highs in January, India stocks have dipped 31.8%.

- As rising infections of the novel coronavirus pose a medical and economic challenge for policymakers worldwide, global investors raced to stock up on cash, dumping even safe haven assets such as gold and government bonds. In India, foreign investors have sold shares worth about $4.4 billion in March alone.

- Oil giant Saudi Aramco will proceed with the reduction of its refinery rates in Saudi Arabia in April and May in order to free up more crude oil for exports.

- The Saudis, who launched an all-out price war for market share with Russia after Moscow refused to back deeper cuts, will not only boost April exports from the current 7 million bpd, but will also grow exports in May by another 250,000 bpd from April.

1$: Rs. 75.18

Import Custom Ex. Rate USD/ INR: 75.75

Export Custom Ex. Rate USD/ INR: 74.05