Acetic Acid Weekly Report 20 Jan 2018

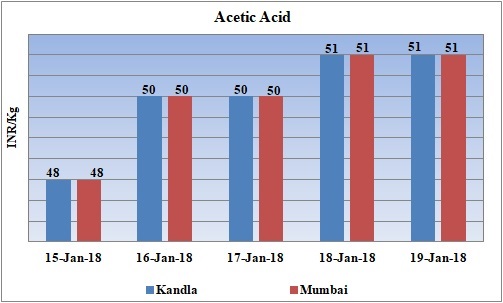

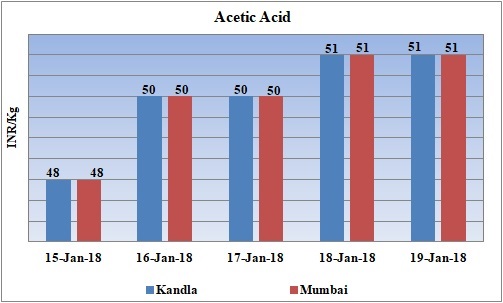

Weekly Price Trend: 15-11-2018 to 19-01-2018

- The above given graph focuses on the Acetic Acid price trend from 15th Jan 2018 to 19th Jan 2018. If we take a quick look at the above given weekly prices, it can be observed that there has been hike in domestic values.

- By end of this week, prices were assessed at the level of Rs.51/Kg for Kandla and for Mumbai port for bulk quantity.

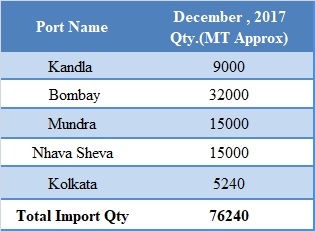

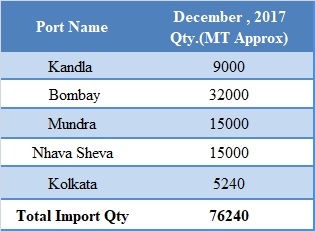

Total import at various ports in the month of December 2017

The above chart depicts the import of Acetic Acid at various ports of India in the month of December 2017.

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid assessed around Rs.51/Kg for Kandla and Mumbai ports of India.

- CFR India values also increased for this week. Prices were assessed in the range of USD 710-730/MT. There has been significant upsurge in crude values in international market. Current values are all time high in last one year. The political tension in Iran has been augmenting the hike in crude values.

- Acetic Acid prices have also increased heavily in China. It has increased by more than 25% in last two months. Heavy snowfall along with disrupted transportation facilities has put an halt on the supply of petrochemical industry.

- Oil prices have followed volatile trend this week. On Thursday Oil rebounded after slipping below $69 a barrel, supported by a record drawdown of U.S. crude stockpiles at the Cushing, Oklahoma delivery hub, despite concerns that OPEC-led output cuts will increase supply from the United States.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $63.95/bbl; prices have decreased by $0.02/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.07/bbl in compared to last trading and was assessed around $69.31/bbl.

- As per report, the upside is now limited for oil prices. U.S. oil producers will ramp up production in the coming months. Some traders said that prices were unlikely to fall far due to the OPEC-led curbs and the risk of further disruptions.

1$ : Rs. 63.85

Import Custom Ex. Rate USD/ INR: 64.80

Export Custom Ex. Rate USD/ INR: 63.10