Acetic Acid Weekly Report 2 June 2018

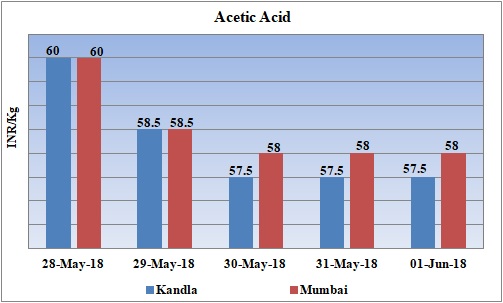

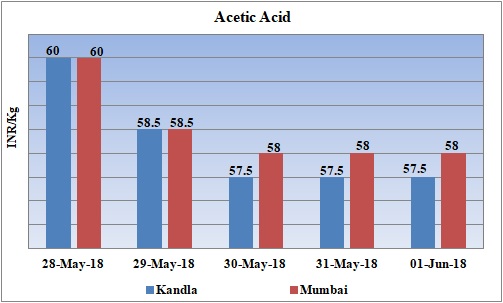

Weekly Price Trend: 28-05-2018 to 01-06-2018

- The above given graph focuses on the Acetic Acid price trend from 28th May 2018 to 1st June 2018. If we take a quick look at the above given weekly prices, it can be observed that prices has been increasing week over week.

- Domestic prices have increased to high level due to acute supply in the local market.

- By end of this week, prices were assessed at the level of Rs.57.5/Kg for Kandla and Rs.58/Kg for Mumbai port for bulk quantity.

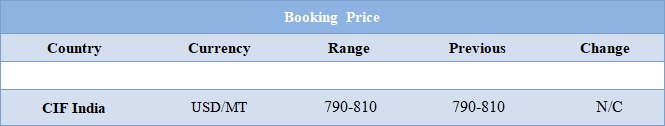

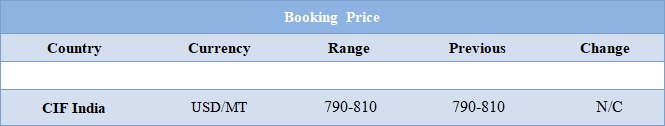

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid assessed around Rs.57.5/Kg for Kandla and Rs.58/Kg for Mumbai port of India. Prices remained vulnerable throughout this week.

- CFR India price were assessed around USD 790-810/MT with no change in compare to last week’s closing values.

- There has been acute supply of chemical in the domestic market which in turn has led to significant hike in prices. The prices are expected to soar up further as there is no relief in the supply end.

- There has been significant hike in Indian domestic marker for Acetic acid values. One month prices were floating in the range of Rs.30-35/Kg. Now it has doubled to Rs. 60/Kg for Kandla and Mumbai port. The acute shortage of material in its peak demand season is the major factor behind this hike in values. As mentioned earlier there has been major shut down and force majeure at Acetic Acid plant based in US in last few weeks. This has led to higher demand from US market for Acetic Acid. To mention few BP has shut down its Acetic Acid unit based in Texas. Most of the material of China has been now shipped to US market as better economic values are being earned over there.

- In China itself the market condition are not so good. The Acetic Acid supply is very limited as many of the major units are shut down or will undergo maintenance. To add further there has been heavy demand from PTA industry along with VAM manufacturers. Few major units are expected to start their production in the next month.

- This week oil prices followed a mixed trend. On Thursday U.S. crude prices sank after a brief rally in the previous session, but as per analysis the recent slump in oil prices won't last much longer.

- On Thursday, closing crude values have remained mixed. WTI on NYME closed at $67.04/bbl; prices have decreased by $1.17/bbl in compared to last closing prices. While Brent on Inter

- Continental Exchange increased by $0.09/bbl in compared to last trading and was assessed around $77.59/bbl.

- Oil prices were already heading lower on recent reports that OPEC, Russia and several other producer nations could soon begin winding down their 17-month-old deal to cap output. That agreement has drained a global glut of oil and helped balance the market, but it's now under review due to falling Venezuelan output and renewed U.S. sanctions against Iran.

- Market players said that supply and demand in the oil market are finely balanced, and surging U.S. output might not be enough to offset supply disruptions in Venezuela and Iran. Oil market fundamentals and OPEC policy could support oil at around $70 a barrel or higher.

1$ : Rs. 67.05

Import Custom Ex. Rate USD/ INR: 68.65

Export Custom Ex. Rate USD/ INR: 66.95