Acetic Acid Weekly Report 18 June 2018

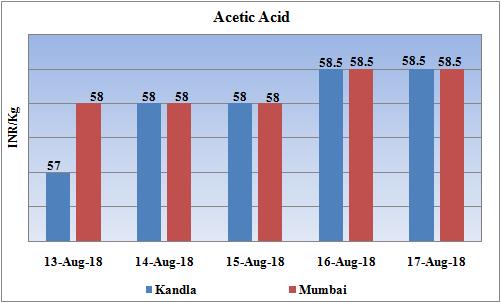

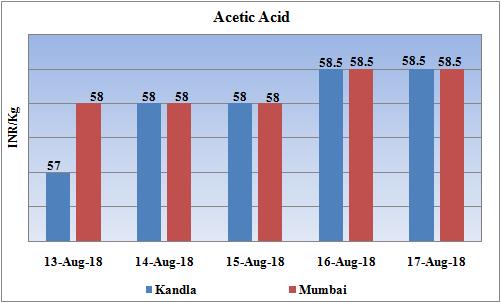

Weekly Price Trend: 13-08-2018 to 17-08-2018

- The above given graph focuses on the Acetic Acid price trend from 13th Aug 2018 to 17th Aug 2018. If we take a quick look at the above given weekly prices, it can be observed that prices increased throughout this week.

- Domestic prices increased significantly in compare to last week’s closing values.

- By end of this week, prices were assessed at the level of Rs.58.5/Kg for Kandla and for Mumbai port for bulk quantity.

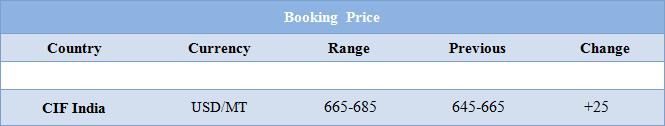

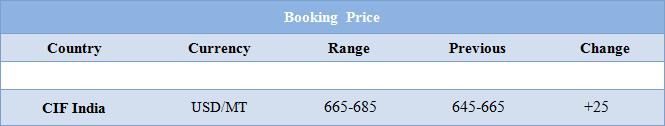

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid assessed around Rs.58.5/Kg for Kandla and for Mumbai port of India. Prices increased in compare to last week’s closing values.

- CFR India price were assessed around USD 665-685/MT, increased by USD 20/MT in compare to last week’s closing values.

- Prices in Indian market are likely to remain firm as demand has improved in last few weeks.

- The other major reason for increase in international as well as domestic market is that there has been significant decline in Indian currency on Monday. The rupee crossed the mark of Rs.70 against US currency. The ongoing low in global currencies following fears that Turkish economic crisis could engulf world economy. Experts believe that rupee was mainly impacted by a fall in Turkish Lira. Further the RBI intervention helped to recover from heavy losses and pushed the rupee to close at all time low level of 69.91. All the payments in petrochemical industry are done in dollar so this will have an adverse impact on prices of petrochemical products.

- Like other global currencies Chinese Yuan has also drifted significantly in last few months. Yuan has reduced by 10% against US dollar. Similar scenario is witnessed by Lira of Turkey and Rupees of India.

- Plunging of Yuan has compelled the importers to look for domestic market to cover up their requirements. A weak currency makes US dollar-denominated imports more expensive. As China is a major importer of petrochemical products in Asia, its absence translates to some downward pressure on regional markets. But firming Chinese domestic markets due to a sudden increase in demand as imports dwindle, also buoy up regional prices of some petrochemical products.

- The major petrochemical products like Benzene and Methanol are falling shortage on the ports thus prices will soon reach the high marks in the next few weeks.

- This week crude oil prices have followed volatile trend. On Friday Crude prices edged higher, but were heading for yet another weekly decline on worries that oversupply would weigh on the U.S. market and that trade disputes and slowing global economic growth would slow demand for oil.

- On Friday, closing crude values have increased. WTI on NYME closed at $65.91/bbl. Prices have increased by $0.45/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.40/bbl in compare to last closing price and was assessed around $71.43/bbl.

- As per analysts, despite the bearish factors, prices were prevented from falling further because of U.S. sanctions against Iran, which target the financial sector from August and will include petroleum exports from November.

1$ : Rs. 70.15

Import Custom Ex. Rate USD/ INR: 71.10

Export Custom Ex. Rate USD/ INR: 69.40