Acetic Acid Weekly Report 14 April 2018

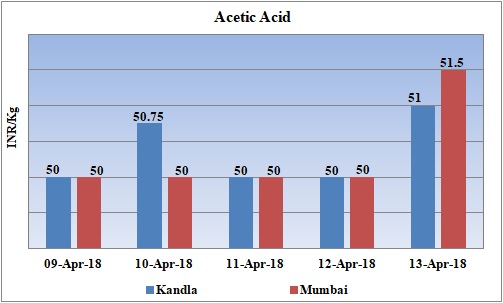

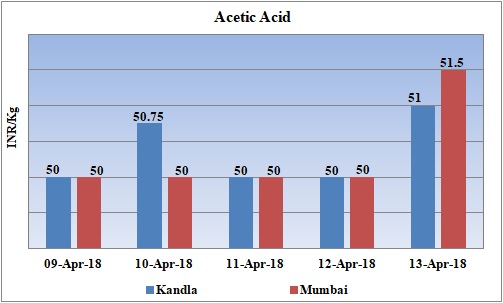

Weekly Price Trend: 09-04-2018 to 13-04-2018

- The above given graph focuses on the Acetic Acid price trend from 9th April 2018 to 13th April 2018. If we take a quick look at the above given weekly prices, it can be observed that prices remained vulnerable throughout this week.

- By end of this week, prices were assessed at the level of Rs.51/Kg for Kandla and Rs.51.5/Kg for Mumbai port for bulk quantity.

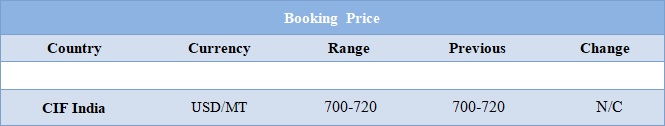

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid assessed around Rs.51/Kg for Kandla and Rs.51.5/Kg for Mumbai port of India. There has been improvement in Acetic Acid values in domestic as well international market.

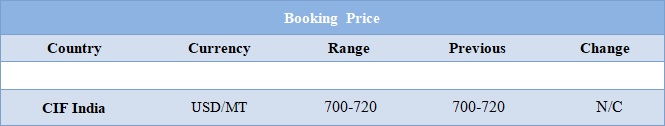

- CFR India price were assessed around USD 700-720/MT with no change in compare to last week’s closing values.

- China based Shanghai Wujing Chemical Corp will shut down its Acetic Acid unit for maintenance turnaround. The unit will go off-stream either in April or May. The restart date has not been specified yet. Unit based in China has the manufacturing capacity of 700 MT/year.

- China based Yankuang Cathay Coal Chemical will shut down its Acetic Acid unit for maintenance turnaround. The unit will go off-stream in the first week of May. Unit is likely to remain off-stream for around one month. Unit based in China has the manufacturing capacity of 1000 MT/year.

- Oil prices have escalated through the week but on Thursday prices have remained mixed.

- On Thursday, closing crude values have mixed. WTI on NYME closed at $67.07/bbl; prices have increased by $0.25/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.40/bbl in compared to last trading and was assessed around $72.02/bbl.

- Oil markets remained tense on Thursday on concerns over a military escalation in Syria, although prices were some way off Wednesday's late-2014 highs as bulging U.S. supplies weighed. A trade dispute between the United States and China also kept markets on edge.

- Crude oil prices settled at three-year highs amid ongoing expectations that geopolitical tensions in the Middle East could add a possible ‘fear premium’ to oil, while continued OPEC cuts supported sentiment.

- If the U.S. does indeed launch missiles at Syria, this would heighten risk and likely at once push crude oil higher and depress equities further.

1$ : Rs. 65.20

Import Custom Ex. Rate USD/ INR: 65.90

Export Custom Ex. Rate USD/ INR: 64.20